Are you planning to travel abroad? Don’t you find it difficult to manage your expenses on your overseas trips? If your answer is yes, we’re here with a quick solution- the forex card. If you love travelling, a forex card is a must-have for you.

It allows us to carry any currency of our choice and makes the payment process smooth and comfortable for us. Just like any other debit/credit card, with forex cards, you can withdraw cash from an ATM. This article suggests the best forex cards in India, to make you travel free from any hassle and worries.

Making your traveling experience smooth allows you to pay on your bus or train tickets, taxi fares, restaurant bills, shopping, and many more with a simple swipe of your card.

What Is A Forex Card?

A Forex card, also known as a prepaid card, prepaid travel money card, or travel money card, is one of the safest and inexpensive ways of carrying money while traveling to another country. It is one of the most accepted ways of carrying foreign currency, therefore it’s like a blessing to all the travelers.

Forex card is a type of prepaid credit card which allows you to deposit funds in foreign currency as per your preference based on the country you will be visiting. You can simply pay directly through the card or you can even withdraw cash from the ATMs. You don’t need to worry about carrying money everywhere and this option is much safer.

Types Of Forex Cards In India?

There are various types of Forex cards but are distinctly divided into two main categories. The two main categories of Forex cards in India are as follows:

Single Currency Forex Cards

As the name suggests, single currency forex cards are the one which can only be loaded with a single currency, which can be reloaded as many times as the user wants. This single currency card has a high-cross currency charge whenever the users use different currency and consist of limited benefits.

Multi-Currency Forex Card

With multi-currency forex cards, users can preload the card with multiple currencies, depending on the type of card they have chosen.

The Banks, financial institutions, and travel agencies offer the applicants the choice depending on the currency they want to load in their respective cards. A card that consists of 23 different currencies can be used all over the world. It provides some additional cost benefits to its users as well.

Various other forex cards are also being introduced with their unique features like the Student Forex cards for students who have an interest in traveling abroad as well as the Contactless Forex cards that help the users to pay at the retail outlets in a much safer way. Accordingly, people should go for forex cards which benefit them as per their requirements.

10 Best Forex Cards In India

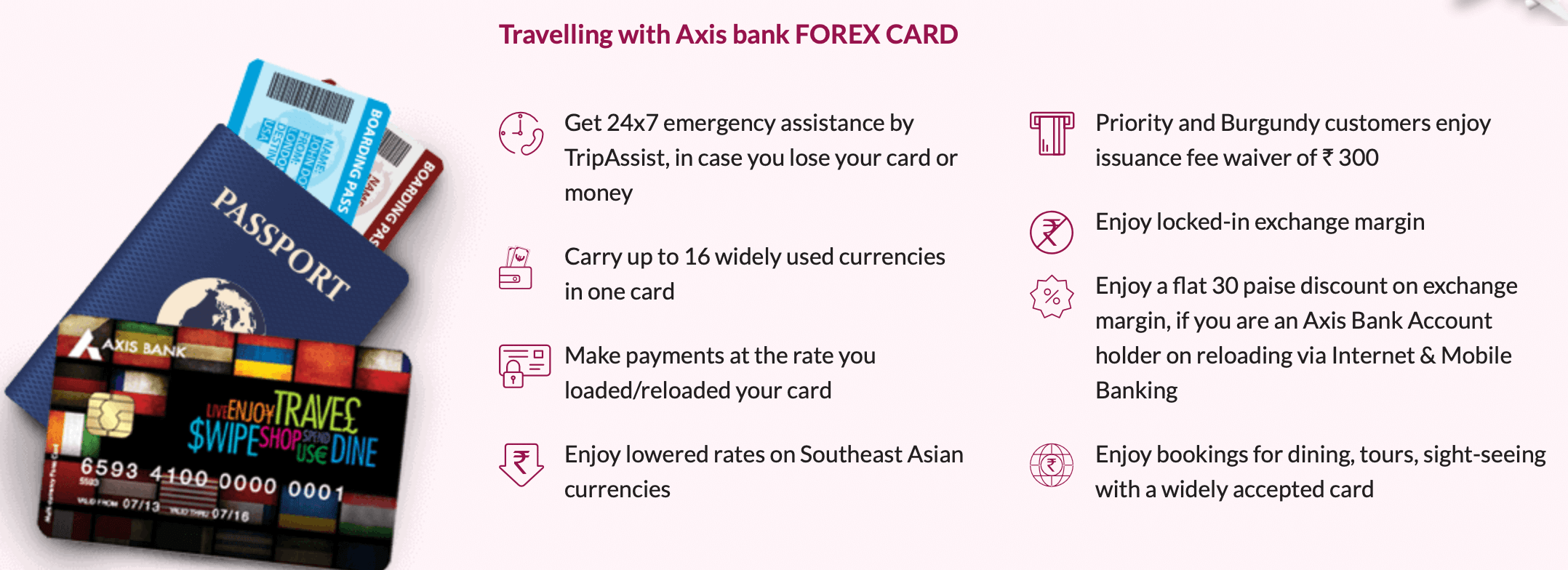

1. Axis Bank Multi-Currency Forex Card

Axis Bank Multi-Currency Forex Card is one of the best forex cards in India, it helps the applicants as they don’t necessarily need to reload their cards with different currencies every time they travel to a new destination. This card also protects from currency fluctuations.

This card even helps you encash your money once you finish the trip. With the help of contactless technology, the users don’t need to have any contact and can easily pay by merely waving the card across the contactless reader.

There is also a function provided like an Image Forex card where the applicant can add an image to their cards, it can be their personalized picture or even some offered by Axis Bank.

The currencies that can be loaded are as follows:

USD, Euro, British Pound, Singapore Dollar, Australian Dollar, Canadian Dollar, Japanese Yen, Swedish Krona, Thai Baht, United Arab Emirates Dirham, Saudi Riyal, Hong Kong Dollar, New Zealand Dollar, Danish Krone, South African Rand.

Fees:

- Initial Insurance Fees: Rs 300 plus GST

- Reload: Rs 100

- The Reactive Fee: Rs 100.

- Cross-Currency Charges: 3.5%

- The Validity of these cards is up to 5 Years.

2. YES Bank Multi-Currency Travel Card

YES Bank Multi-Currency Travel Card is also one of the best forex cards in India because it is highly secured and cost-efficient. The good thing is that you can easily manage this card from anywhere and at any time from the customer care portal online. You can also observe your previous transaction.

The currencies that can be loaded are as follows:

USD(United States Dollar), GBP (British Pound), EUR (Euro), SGD (Singapore Dollar), AUD (Australian Dollar), AED (UAE Dirhams), JPY (Japanese Yen), CAD (Canadian Dollar), HKD (Hong Kong Dollar), CHF (Swiss Franc)

Fees :

Insurance Fees: Rs 125

Reload: Rs 100

Validity: 2 Years and during this time users can reload it as many times as they want.

Also Read: 10 Best Credit Cards for Online Shopping

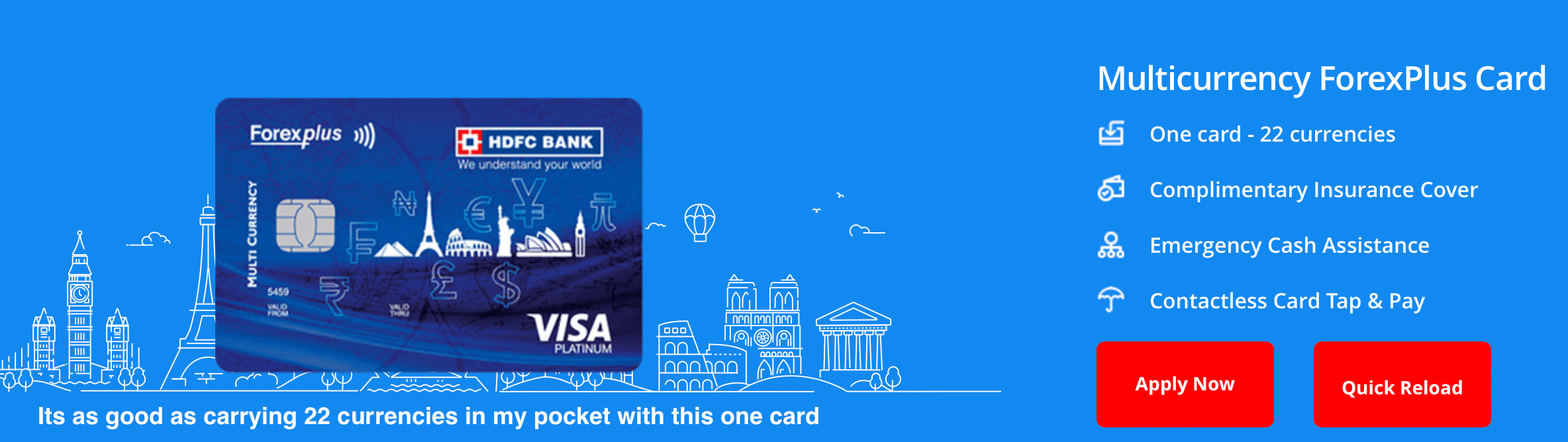

3. HDFC Multi-Currency Forex Card In India

HDFC Multi-Currency Forex card is one of the most popular in the market. It offers about 22 currencies under a single card.

These cards provide features like shuffle funds between two different currencies and it is contactless with additional insurance coverage and concierge services. In addition, they also protect users from forex currency fluctuations.

Customers also get compensation up to Rs 5 lakhs to protect them from any misuse.

The currencies that can be loaded are as follows:

US Dollar, New Zealand Dollar, Kuwait Dinar, Australian Dollar, Hong Kong Dollar, Qatari Riyal, Canadian Dollar, Singapore Dollar, Bahrain Dinar, Euro, Oman Riyal, Korean Won, UAE Dirhams, Japanese Yen, Saudi Riyal, Sterling Pound, Malaysian Ringgit, Norwegian Krone, Swiss Franc, Thailand Baht, Danish Krone, Swedish Krona, South African Rand

Fees:

Issuance Fee: Rs 500 plus GST

Reload Fee: Rs 75 plus GST

Reactive fee: Rs 100

Cross currency charges: 2%

4. Indusind Bank Multi-Currency Forex Card In India

Indusind Bank Multi-Currency Card is famous among those who travel abroad frequently. This card offers 14 different currencies with add-on features like zero foreign markup rates and the fact that it can be operated online. It provides additional benefits like customers can get up to two free ATM withdrawals per month.

The currencies that can be loaded are as follows:

US Dollar (USD), Canadian Dollar (CAD), Australian Dollar (AUD), Saudi Riyal (SAR), Euro (EUR), Singapore Dollar (SGD), British Pound (GBP), United Arab Emirates Dirham (AED)

Fees:

Issuance Fee (single card): Rs.150 plus GST

Issuance fee (paired card): Rs 250

Reload Fee: Rs.100 plus GST

Cross Currency Charges: 3.5%

5. Thomas Cook Forex Card In India

Thomas Cook is one of the popular travel companies that also offer forex cards in India. With their card you can even send money abroad, they offer 9 different currencies. It is a trusted brand and provides insurance coverage of about $10000. In addition, features include toll-free customer service, which is available on online platforms helping in checking balance, statements, and blocking cards.

The Currencies That Can Be Loaded Are As Follows:

US Dollars, Euro, Australian Dollars, British Pounds, Swiss Francs, Canadian Dollars, Singapore Dollars, Japanese Yen

Fees:

Issuance Fee: Rs.150 plus GST

Reload Fee: Rs.100 plus GST

6. ICICI Bank Forex Prepaid Cards

ICICI Bank Forex Prepaid Card is a great choice if you want to travel to a specific location or destination. It is flexible to work with your travel plans. You can reload this card at any ICICI forex branches, their online platform, or even their iMobile application.

Moreover, it provides additional benefits like 20% discounts on restaurant bills, shopping, and various other outlets worldwide. They also provide insurance cover up to Rs 10,00,000. No savings or current accounts are required with ICICI bank to open this account and they even deliver the card in merely 2 days.

The Currencies ICICI Forex Card offers to load different currencies:

US Dollar (USD), Singapore Dollar (SGD), British Pound (GBP), Australian Dollar (AUD), Arab Emirates Dirham (AED), Canadian Dollar (CAD), Euro (EUR), Swiss Franc (CHF), Japanese Yen (JPY), Swedish Krona (SEK), South African Rand (ZAR), Saudi Riyal (SAR), Thai Baht (THB), New Zealand Dollar (NZD), Hong Kong Dollar (HKD)

Fees & Charges:

Issuance Fee: Rs 150 (One time)

Reload Fee: Rs 100

Reactive Fee: USD 5 (for every 180 days of inactivity)

Cross Currency Fee: 3.5%

Also Read: Top 10 International Banks in India

7. SBI Multi-Currency Foreign Travel Card

SBI Multi-Currency Foreign Travel Card is one of the safest and wise options when it comes to forex cards in India. It can be loaded with 7 currencies from different countries. You can use it for many payments like for restaurant bills, shopping, dining, and other accommodation bills worldwide as it consists of the MasterCard Acceptance Mark. It is available 24/7 worldwide.

The Currencies That Can Be Loaded Are As Follows:

US Dollars (USD), Pound Sterling (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Japanese Yen (YEN), Saudi Riyal (SAR), Singapore Dollar (SGD)

Fees:

Insurance Fees: Rs 100 plus GST

Add-on Fees: Rs 100 plus GST

Reloading Fees: Rs 50 plus GST

8. Axis Bank Diners Card

Axis Bank Diner cards only allow the applicants to load USD. They provide gift cards that give you 2 points every time you purchase up to 5 USD. Moreover, its additional benefits consist of medical treatment and ATM robbery for up to Rs 60,000.

Users are free to encash their balance to their domestic accounts.

Fees:

Card Activation Charge: Rs150 plus GST

Reload fee: Rs 100 plus GST

Add-on Card Fee: Rs 100 plus GST

9. HDFC Bank ISIC Student ForexPlus Card

HDFC Bank ISIC Student ForexPlus Card was introduced for students as its name suggests and helps with the student identity card. It comes with additional benefits as well as discounts in around 130 countries for books, travel expenses, and many more. The baggage loss charges are about Rs 50,000 and passport reconstruction covers up to Rs 20,000. In addition, Customers get benefits like free complimentary international SIM with a talk time of Rs 200 and it can be excessed 60 days before the day of travel.

The Currencies That Can Be Loaded Are As Follows:

USD, Euro, and Sterling Pounds

Fees:

Card Issuance Fees: Rs 300

Reload Fees: 75

Re-issuance Fees: Rs 100

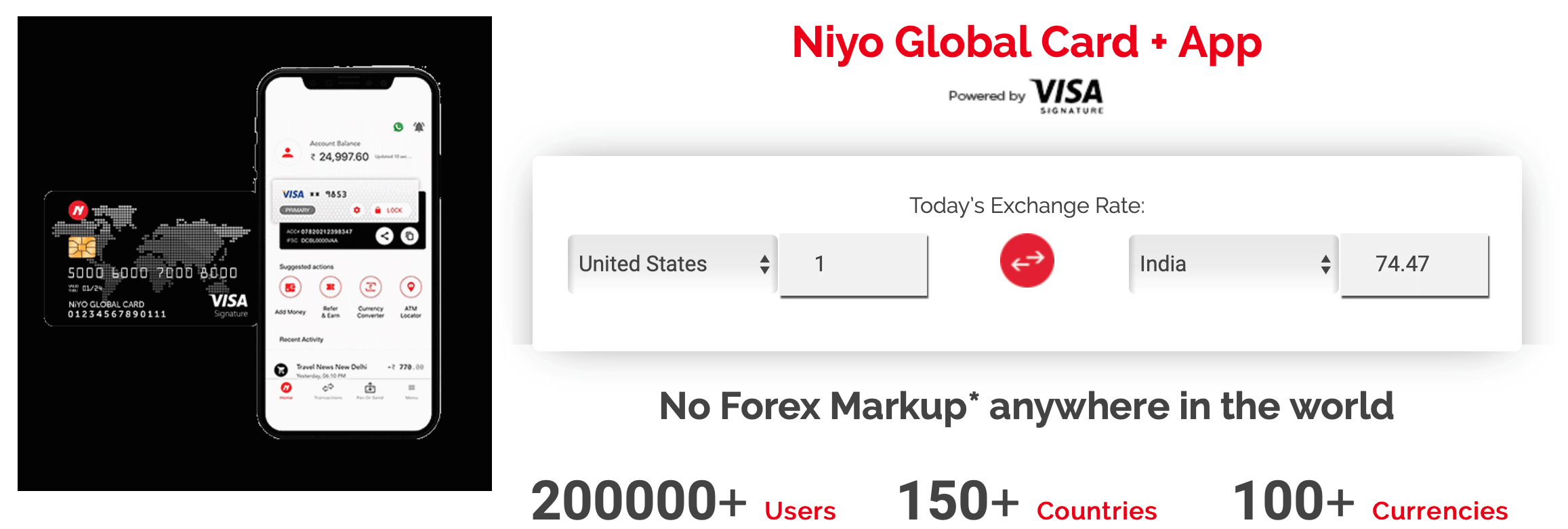

10. Niyo Global Card

Niyo Global Card is the best and most famous forex card as reviewed by one of the leading travelling companies. This is issued with the cooperation of DCB Bank. Moreover, it can be easily operated by their mobile application, you can even lock the card if it’s not in use.

Fees:

Joining Fees and Renewal Fees: Zero

ATM Withdrawal: Zero

Also Read: Top 15 Best Debit Cards in India

Best Forex Cards In India – Comparision

| Sr. No. | Card | Initial Insurance Fee (in Rs) | Reload Fee | Additional Benefits |

| 1 | Axis Bank Multi-Currency Forex Card | 300 plus GST | 100 (₹) | Protects from currency fluctuation.You can encash your money at your arrival. Contactless technology and Image Forex card features are also available. |

| 2 | YES Bank Multi-Currency Travel Forex Card | 125 | 100 (₹) | Highly secured and cost-efficient.Can be operated at any time and everywhere with their online portal. |

| 3 | HDFC Multi-Currency Forex Card | 500 plus GST | 75 (₹) plus GST | Shuffle funds between two different currencies,It is contactless with additional insurance coverage and concierge service.Also protects from currency fluctuations. |

| 4 | IndusInd Bank Multi-Currency Forex Card | 150 (single) 250 (paired)(plus GST in both) | 100 (₹) plus GST | Customers get two free ATM withdrawals per month.Applicable for 14 currencies with add-on features like zero foreign markup rates.It can be operated online and is good for people who travel frequently. |

| 5 | Thomas Cook Forex Card | 150 plus GST | 100 (₹) plus GST | You can even send money abroadThey offer 9 different currencies.toll-free customer service, which is available on online platforms helping in checking balance, statements, and blocking cards. |

| 6 | ICICI Bank Forex Prepaid Card | 150 (one time) | 100 (₹) | It is people who want to travel to a specific location.You can reload this card at any ICICI forex branches, their online platform, or even their iMobile application.Provides 20 % discounts on the restaurant bills, fares, dining expenses, etc. |

| 7 | SBI Multi-Currency Foreign Travel Card | 100 plus GST | 50 (₹) plus GST | It can be loaded with 7 currencies from different countries. You can make many payments like for restaurant bills, shopping, dining, and other accommodation bills worldwide as it consists of the MasterCard Acceptance Mark. It is available 24/7 worldwide |

| 8 | Axis Bank Diner Card | 150 plus GST | 100 (₹) plus GST | Only allow the applicants to load USD. They provide gift cards that give you 2 points every time you purchase up to 5 USD. Its additional benefits consist of medical treatment and ATM robbery for up to Rs 60,000. |

| 9 | HDFC Bank ISIC Student ForexPlus Card | 300 | 75 (₹) | It helps with the student identity card. Customers get free complimentary international SIM with a talk time of Rs 200 and it can be excessed 60 days before the day of travel.Provides discounts in around 130 countries for books, travel expenses, and other expenses.The baggage loss charges are about Rs 50,000 and passport reconstruction covers up to Rs 20,000. |

| 10 | Niyo Global Card | NA | NA | This is issued with the cooperation of DCB Bank. Moreover, it can be easily operated by their mobile application, you can even lock the card if it’s not in use. |

Also Read: Top 8 Best Credit Cards in India

Final Thoughts

Forex cards in India are gaining more and more popularity with the changing times. A forex card is like a blessing for all travellers, rendering them a cost-effective way of making payments flexibly and effortlessly. With their additional benefits, it’s like a deal that shouldn’t be missed if you’re a travel enthusiast and love travelling. In conclusion, making your travelling experience blissful and as per your requirements like a single currency card if you want to travel to one country and multi-currency forex cards for different countries and add-on benefits.

Frequently Asked Questions

What Can Be The Minimum Amount For Loading My Forex Card?

It depends on the cardholder as well as which card is issued.

What Can Be The Minimum Amount For Loading My Forex Card?

Forex cards are more profitable and competitive for international travel. It is widely accepted and also saves conversion fees.

Can I Reload My Card From Overseas?

No, you can not reload your card from overseas as most companies don’t allow that but instead you can assign one person to refill your card on your behalf.

How Can I Withdraw Money Using A Forex Card?

You can withdraw money simply by visiting any ATM and choose the ‘credit card’ option as the type of card. After that, you just have to follow the instructions mentioned on the screen.