Choosing the best credit cards in India can be overwhelming. Not just about the documentation part, but also the plethora of options available from Indian banks.

The best credit cards in India have everything from cashbacks to free hotel stays to complimentary flight tickets to lounge access etc.

There is no single best credit card in India that fits the needs of every person. They vary by their features, and the fees they charge per transaction or month.

However, if you want to get started with buying your first card, continue reading for best credit cards in India comparison. Some of these have instant credit card approvals in India.

How To Find Your Credit Score In India?

Before you sign up for any credit card, your credit score will be checked thoroughly. Essentially, the credit score reflects your capacity to pay back the credit debt on time. A higher credit score means you are more likely to pay back your dues on time.

This credit score is obtained from your past credit-based transactions. These include and are not limited to credit inquiries, loan repayments, length of your history of credit, etc.

The CIBIL credit score in India is a 3-digit value that lies between 300 and 900. 900 is the highest credit value and 300 is the lowest.

In India, the credit score can be seen on 4 websites out of which CIBIL is the most popular. It has a maximum score of 900 and any score above 750 qualifies you for most credit cards in India.

The credit report from CIBIL has four important sections that are thoroughly scrutinized before issuing you the credit card – Public Records, Credit Enquiries, Account History, and Credit Summary.

The other companies in India through which you can obtain your credit information are Experian, Equifax, and CRIF High Mark.

If you have a good credit score, you can get access to the best credit cards in India.

Credit Card India Review – Best Credit Cards In India – 2021

Best Credit Cards In India:

- SBI SimplyClick Credit Card – Best Credit Card for New Customers in India

- Axis Bank Ace Credit Card – Highly Rewarding

- Axis Bank Ace Credit Card – Highly Rewarding

- Amazon Pay ICICI Bank Credit Card – One of the Best Co-branded Cards in India

- HDFC Regalia Credit Card – One of the Best Premium Cards in India

- DFC First Credit Cards – One of the Best New Credit Cards in India

- Standard Chartered Super Value Titanium Credit Card

- SBI IRCTC Credit Card – To Make Your Train Travel Rewarding

Recommended: Best Debit Cards In India

Here’s the compilation of the best credit cards in India in 2021 according to trusted reviews, popularity, features, and pricing per transaction. Note that the list is not exhaustive and is not in any order of popularity or ranking.

1. SBI SimplyClick Credit Card – Best Credit Cards In India For Beginners

This is one of the best credit cards in India for the newbie. Ideal for people who spend around INR 1 lakh per year on credit. Since the card is issued by the SBI, the organization is highly secure and trustworthy as well.

- You get returns of 1.25% on all the online transactions and with certain sellers on Amazon, you get a 2.5%. You can also check out the offers sections on Amazon to check if this credit card is eligible for any other discount.

- You get rewarded on Flipkart occasionally with a 10% off. Not just this, with usage, you become eligible for Cleartrip vouchers which you can use for hotel, flight, and train bookings on the platform.

- The Annual Fee is INR 499 plus the applicable taxes. As a welcome gift, you get an INR 500 voucher that can be redeemed on Amazon. The renewal fees for the card is also INR 499 plus the applicable taxes although this is waived off on a spend of INR 1 lakh.

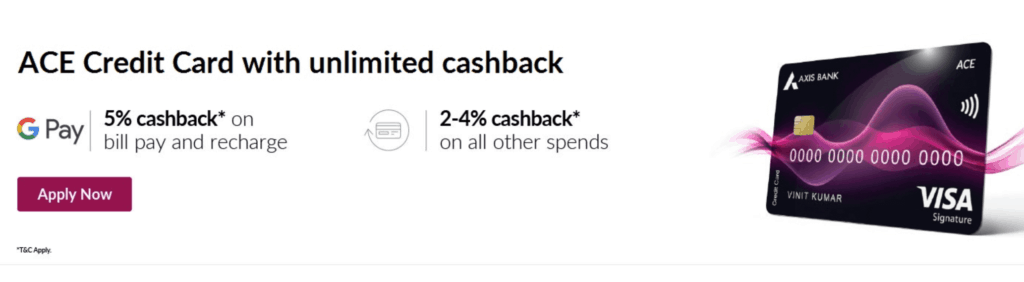

2. Axis Bank Ace Credit Card – Highly Rewarding

Since Google Pay is the partner, the credit card offers highly promising rewards for its customers. On almost all types of expenditure, you get a 2% cashback which will be reflected on the statement. This also makes it one of the best credit cards in India for beginners.

- If you are a frequent domestic air traveler, this card provides a lot of lounge access and benefits.

- Depending on the transactions, the reward rate of this best credit card in India can be anywhere between 2% and 5%.

- The joining fee is the same as the renewal fee and both are INR 500 + GST. The joining fee will be given back to you if you spend INR 10,000 and more within 45 days.

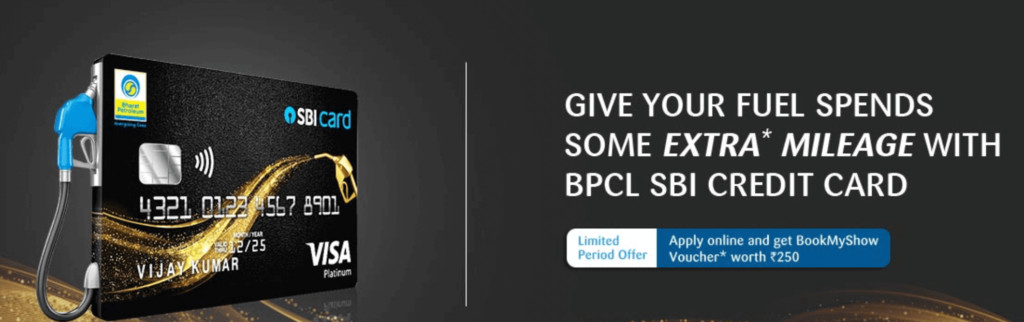

3. SBI BPCL Card – Best Card For Fuel Based Rewards

At the time of writing this article, the rising fuel prices are in the news. This is concerning to people who use their vehicles regularly.

One way to alleviate the impact of rising prices is to get rewards and cashbacks on the money you spend on fuel. To enable just that, the SBI BPCL Card came into the scene. It is one of the best credit cards in India for fuel savings.

- You get 25x reward points when you get fuel from BPCL Petrol Pumps

- For every INR 100 spent on Bharat Gas, Lubricants, and BPCL Fuel, you get 25 reward points. In one billing cycle, you can accumulate a maximum of 2500 reward points.

- The annual fee for the card is INR 1,499 plus GST. The renewal fee is also INR 1,499 + GST but it will be waived off on annual spending of INR 2 lakh and more.

- You will get to know the minimum income required, once you talk to the credit card executives.

4. Amazon Pay ICICI Bank Credit Card – One Of The Best Credit Cards In India For Co-Branding

The benefits that you can get from co-branding reach a new high with the Amazon Pay ICICI Credit Card. If you are a frequent Amazon shopper, you can earn a lot from the cashback you get by paying through this card. The best part of this best credit card in India is that there is no joining fee or renewal fee.

- 5% cashback for all Amazon Prime customers for purchases on Amazon. This cashback can be applied on top of other offers.

- 3% cashback for all non-Prime customers for purchases on Amazon.

- Eligibility for no-cost EMI for purchases above INR 3000 for 3 months or 6 months.

- No annual fee and no renewal fee

5. HDFC Regalia Credit Card – One Of The Best Premium Cards In India

It is the flagship credit card of HDFC and it has been around the credit card scene for many years now. Therefore, the card has a large user base.

This card is an upgrade to the Regalia First. Through these cards, you get offers on almost all HDFC merchants and also lower fees on foreign currency exchange transactions. Apart from this, you also get benefits on milestones.

- With various merchants, you get 2x / 5x / 10x reward points.

- Milestone rewards of 10,000 reward points on annual spending of more than INR 5 lakh.

- The joining fee and the renewal fee are INR 2,500. For annual spending of more than INR 3 lakh, the renewal fee is waived off.

At the time of writing this article, applications have been temporarily stopped for this credit card. But if you have existing HDFC cards, you can upgrade.

6. IDFC First Credit Cards – One Of The Best New Credit Cards In India

Compared to the other best credit cards in India, this is one of the most recent. The attractive point of this credit card is that there is no joining free. This card is particularly rewarding if you spend more than INR 20k online every month.

- The interest of the credit card is quite low (around 9% per annum)

- There is no expiry of reward points

- Access to railway lounge on all IDFC Credit Cards

- You can get reward points up to 10x the actual value on specific transactions

- No joining fee

7. Standard Chartered Super Value Titanium Credit Card

This card is specifically designed for those who want rewards for every transaction through their credit card. On all spends, this best credit card in India for savings gives cashbacks and rewards including on fuel spends.

- On utility bill payments, fuel spends and phone recharges, you get a cashback of 5%

- For every INR 150 spent, you earn 1 reward point

- The annual fee and renewal fee is INR 750 + GST.

- The minimum income required is INR 55,000 per month.

8. SBI IRCTC Credit Card – One Of The Best Credit Cards In India To Make Your Train Travel Rewarding

If you are a frequent traveler on the train, this card can save you up to 10% on train journeys across India. If you travel through the railways more than 40 times annually, this card is the right one for you.

- Apart from IRCTC spends, you get 0.8% as points, where 1 reward point is offered for INR 125.

- During the peak season of IRCTC bookings, you get 10% as points and during the off season, you get 4% as points.

- The joining and renewal fee is INR 500 + GST

- As a welcome benefit, you get 350 points.

Comparison Chart For The Best Credit Cards In India

| Credit Card | Ideal For | Joining Fee | Renewal Fee |

| SBI SimplyClick Credit Card | New Credit Card Customers | INR 499 + taxes | INR 499 + taxes – waived off with spends of INR 1 lakh |

| Axis Bank Ace Credit Card | If you are looking for more rewards | INR 500 + GST | INR 500 + GST |

| SBI BPCL Credit Card | Needing savings on fuel | INR 2500 | INR 2500 – waived off with spends of INR 3 lakh |

| Amazon Pay ICICI Bank Credit Card | Looking for co-branded cards with high rewards | – | – |

| HDFC Regalia Credit Card | Looking for premium cards | INR 2500 | INR 2500 – waived off with spends of 3 lakh |

| IDFC Credit Cards | Looking for unique and latest credit cards | – | – |

| Standard Chartered Super Value Titanium Credit Card | Looking for rewards with every transaction | INR 750 + GST | INR 750 + GST |

| SBI IRCTC Credit Card | Looking for rewards for train travel | INR 500 + GST | INR 500 + GST |

Note that this list of the best credit cards in India is not exhaustive.

Spend Responsibly With Best Credit Cards In India

A credit card is a huge responsibility. If you are confident about your skills in handling money, do not opt for a credit card.

Almost all online e-commerce sites are designed in a way to tempt you into spending more. Therefore, you may exceed your spending capacity before you may realize it and then face a large debt at the end of the month.

Not paying your credit card bills on time has a lot of consequences too including and not limited to lowering of credit scores, hefty late fees, bank accounts freezing, etc.

Final Thoughts – Best Credit Cards In India Review

These are some of the best credit cards in India in 2021. Before you pick one, talk to users who java used the card and the bank that is issuing the card.

Check if the card is eligible for instant best credit cards in India approval. Understand the benefits and choose the best credit cards in India that suits your personality of spending the most.

Frequently Asked Questions

Are Students Eligible For Credit Cards In India?

For most of the standard credit cards, no. However, you can ask the same with the bank if they have any special card for students.

How To Make A Credit Score Better?

Repay your existing dues and loans on time. There are some banks that offer cards for lower credit scores as well. Get them and improve your credit score by paying on time.

Can I Upgrade My Credit Card?

Most banks have this feature to upgrade for their higher-tier credit card after a particular checkpoint. Read the documentation carefully.