India is going cashless and the popularity and usage of credit cards are more than ever. As e-commerce websites are raining offers and deals everywhere to attract people and encourage them to shop more.

In such a situation, one can think about which would be the best credit card for online shopping as per their needs?

Credit cards are the best choice to manage your personal finance. If you can pay your loan in time and have a stable source of income, you may consider owning a credit card.

Otherwise, owning a credit card can land you in trouble and can incur debt. It depends on your spending habits, financial goals, and other factors.

The best rewards for credit cards may vary for each person. You can choose the best credit card for online shopping as per your needs.

Top 10 Best Credit Cards For Online Shopping

A recommended list of the 10 best credit cards for online shopping.

1) Axis Ace Credit Card – Best For Online Shopping

Features:

- Axis Ace Credit Card offers you an unlimited cashback of 5% on bill payments, DTH recharge, and mobile recharge via Google pay.

- It gives 4% cashback to partner companies like Swiggy, Zomato, Ola, and many more.

- Customers get discounts at more than 4000 restaurants,

- Other offers and deals include complimentary lounge access, a fuel surcharge waiver, and 2% straight cashback on regular spending.

- Axis Ace credit card is one of the best credit cards for online shopping as it offers exciting deals and unlimited cashback offers.

Fee:

- Bank charges a joining fee of Rs. 499.

- The annual fee for the Axis Ace Credit Card is Rs. 499 + taxes.

- The cash withdrawal fee for Axis Ace Credit Card is 2.5% of the cash amount.

2) Flipkart Axis Bank Credit Card

Features:

- Flipkart Axis Bank Credit Card is offering up to 20% off at partner restaurants in India.

- Flipkart Axis Bank credit card offers a 1% fuel surcharge waiver on fuel purchases across the country.

- Other services include complimentary airport lounge access, cashback with every transaction, and Rs. 2900 worth of joining and activation benefits for the users of the Flipkart Axis Bank credit card which is one of the best credit cards for online shopping.

- Bank offers 5% cashback on Flipkart, Myntra & 2GUD.

- Other cashback offers include 4% cashback on purchases at the merchant’s place.

- It offers a straight 1.5% cashback on all other spendings by the user.

Fee:

- Axis bank charges a joining fee of Rs. 500.

- An annual fee of Rs. 500 is charged by the bank for using a credit card. However, if users made annual spendings more than Rs. 2,00,000, the annual fee is waived off.

- Cash withdrawal fees are 2.5% of the cash amount.

Flipkart Axis bank’s credit card is one of the best credit cards for online shopping. It is truly a bang for your buck.

3) SBI SimplyCLICK Credit Card

Features:

- SBI SimplyCLICK Credit Card offers a gift voucher from Amazon worth Rs. 500 on joining.

- It offers a fuel surcharge waiver.

- Bag 10X Reward Points on online spendings with partner companies such as BookMyShow, Cleartrip, Amazon, Lenskart, Netmeds, UrbanClap, and many more.

- SBI SimplyClick credit card can earn 5x rewards on all other online spendings.

- e-voucher worth Rs. 2000 on annual online spends of Rs.1 Lakh and Rs. 2 Lakh.

- SBI offers contactless transactions with the credit card and allows maximum transactions of Rs. 2000.

- SBI users can access it worldwide. SBI provides 24 million outlets across the world, including 3,25,000 outlets in the country where VISA or MASTERCARD is acceptable. With worldwide access, it is one of the best credit cards for online shopping.

Fee:

- Bank charges an annual fee of Rs. 499.

- A renewal fee is also charged by the bank of Rs. 499.

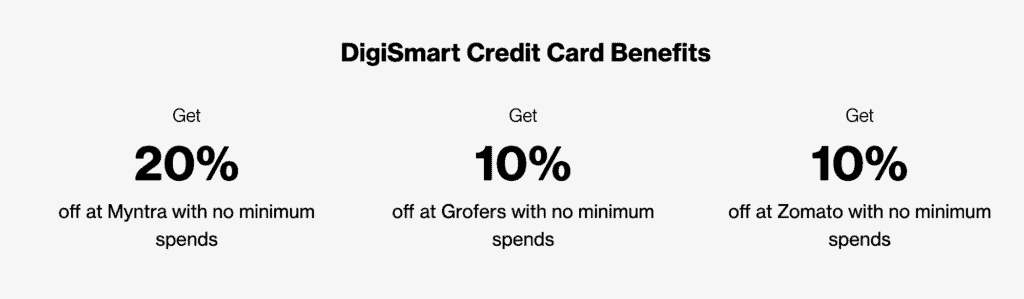

4) Standard Chartered DigiSmart Credit Card

Features:

- Standard Chartered DigiSmart credit card is offered by Standard Chartered Bank, a foreign bank in India with over 100 branches across the country.

- Get 20% off at Myntra with no minimum spends.

- Get 10% off at Grofers and Zomato with no minimum spends.

- Card avails you of various exciting deals on partner companies like Ola, Myntra, Zomato, Yatra, Grofers, Inox, and many more.

- It offers contactless transactions of Rs. 2000.

- DigiSmart credit card is one of the best credit cards for online shopping issued by Standard Chartered bank.

Fee:

- Unlike other banks, they charge a monthly fee of Rs. 49 instead of an annual fee.

- The monthly fee Standard Chartered DigiSmart Credit Card is waived off if monthly transactions cross Rs.5000 per month.

Also Read: Best Debit Cards in India

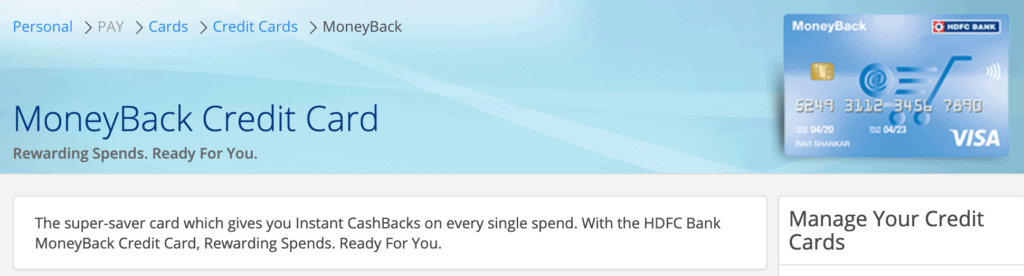

5) HDFC MoneyBack Credit Card

Features:

- HDFC MoneyBack Credit Card Cardholders can earn 2 reward points on every Rs 150 spent and 2x reward points on every Rs. 150 spent online.

- You earn up to Rs. 2,000 worth of gift vouchers in a calendar year.

- HDFC Bank offers zero cost liability on losing the card if reported in 24 hours.

- Other services include a 1% fuel surcharge waiver at all fuel stations.

- They offer exciting milestone benefits on spending Rs. 20000 – Rs. 50000 and above in each calendar quarter.

- Get your renewal membership fee waived off on spending Rs. 50000.

- HDFC Moneyback credit card offers contactless transactions up to Rs. 5000 in a single transaction without any credit card PIN.

- Contactless transactions over Rs. 5000 need a credit card PIN for security reasons.

- With exciting deals and offers, this credit card is one of the best credit cards for online shopping.

Fee:

- Bank charges a joining fee of Rs. 500 + taxes.

- A 2.5% of the cash amount of Rs. 500 (whichever is high) is charged on cash withdrawal.

6) Citi Cashback Card

Features:

- On Citi Cashback Card, Get 5% Cashback on telephone & utility bill payments, and movie ticket purchases.

- Enjoy 0.5% Cashback on all other spendings.

- The rewarded cashback is evergreen and never expires.

- Citi Cashback Card offers you instant loan facilities.

- Other services include discounts and deals on various restaurants, stores, and EMI facilities.

Fee:

- Bank charges an annual fee of Rs. 500.

- Other charges include 2.5 % of cash amount on cash withdrawal, Rs. 250 on depositing cash on Citi branches.

7) HDFC Freedom Credit Card

Features:

- HDFC Freedom Credit Card Customers get 1 reward point on every ₹150 spent. HDFC Freedom Credit Card offers to redeem points for cashback or booking of flights and hotels.

- Bank gives a welcome and renewal benefit of 500 reward points.

- Other offers include 25x reward points on birthday spendings, 10X reward points on PayZapp & SmartBuy spendings.

- Also get 5x reward points on restaurants, movies, groceries, railways, taxi spendings.

- It offers a complimentary 1% fuel surcharge waiver.

- Bank charges zero liability on losing cards if reported immediately.

- This smart credit card also offers contactless transactions up to Rs. 5000.

- HDFC’s products are invariable of the top quality. Freedom credit card is one of the best credit cards for online shopping and travelling.

Fee:

- Bank does not charge any annual fee if the customer spends more than Rs. 50000. Otherwise, the standard charge is Rs. 500.

- On cash withdrawal, 2.5% of the cash amount is deducted by the bank as a fee.

8) Yatra SBI Credit Card

Features:

- Yatra SBI Credit Card offers Yatra.com vouchers worth Rs. 8,250 as a joining gift.

- Get 20% off on domestic flight bookings, 10% off on international flight bookings, and 20% off on domestic hotels.

- On every Rs. 100 spent, the customer gets 6 reward points. It applies to the purchases made at Departmental Stores, Grocery, Dining, Movies, Entertainment, and International transactions.

- Yatra SBI cards offer air accident cover of Rs. 50 lakh.

- Get a 1% fuel surcharge waiver across India on all petrol pumps.

- Customers can access over 1 million MasterCard ATMs and over 10,000 SBI ATMs in India.

- With worldwide access, the card is receiving an uptick from the folks, SBI has issued one of the best credit cards for online shopping which is surely a clincher.

Fee:

- Bank charges a one-time annual fee of Rs. 499.

- From the 2nd year, the bank charges a renewal fee of Rs. 499.

- Like other SBI also charges a cash withdrawal fee that is 2.5% of the cash amount.

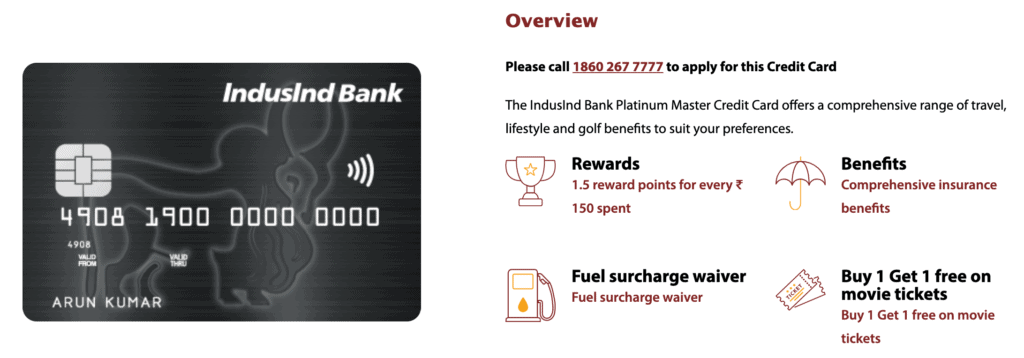

9) IndusInd Bank Platinum Card

Features:

- IndusInd Bank Platinum Card Cardmembers can avail golf games and lessons.

- It offers access to over 600 airport lounges across the globe. The credit card also provides offers on lounge usage charges outside India up to 8 times in a calendar year.

- In a single phone call, you can get various services like pre-trip assistance, hotel reservation, flight booking, entertainment and sports booking, gift assistance, and many more.

- This card is amazingly useful. It offers on-road services like roadside repair service, emergency fuel supply, battery service, flat tire service, and a host of other services.

- Get BOGO (buy 1 get 1) offer on Bookmyshow. Customers can use this offer for up to 2 free movie tickets every month.

- Get a 1% surcharge waiver on the fuel transactions.

- Bank charges zero liability on lost or stolen cards.

- It provides personal air accident insurance worth Rs. 25 lakh.

- Arguably, this is one of the best credit cards for online shopping.

Fee:

- You will be amazed to know that banks do not charge any annual or joining fee and it is surely a bang for your buck. It is one of the best credit cards for online shopping.

- The bank charges 2.5% of the cash amount on every cash withdrawal.

- If the IndusInd Bank Platinum Card is lost or stolen, the bank charges a fee of Rs. 100 to re-issue a new card.

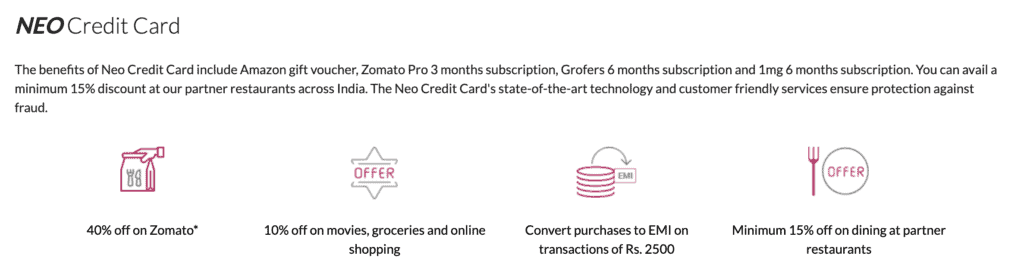

10) Axis Bank Neo Credit Card

Features:

- In Axis Bank Neo Credit Card, On the first transaction get an Amazon gift voucher worth Rs. 250 and BookMyShow gift voucher worth Rs.300.

- Other offers and discounts include 10% off on every purchase on BookMyShow, 10% off every time on shopping with Myntra.

- Other partner brands get 40% off on Zomato, 5% off on utility bill payments, and 10% off on Grofers.

- It also offers a Zomato pro subscription for the first 3 months.

- It offers 1 reward point for every Rs.200.

- Bank offers zero liability on losing cards if contacted immediately.

Fee:

- With a low annual fee of Rs. 250, Axis bank offers one of the best credit cards for online shopping.

- Other fees include Rs. 250 as joining fee, Rs. 100 on card replacement, and a 2.5% cash withdrawal fee.

Must Read: Best Credit cards in India

Pros And Cons Of Credit Cards

Pros Of Credit Card:

- Credit cards are safer and convenient than carrying cash around. If your card is stolen or lost, it can be cancelled within minutes.

- Customers will get interest-free days if they repay the amount in time. You can use the reward in the future.

- Card users can earn reward points on spending. Later, these rewards can be redeemed for discounts or as cashback.

- Credit cards are best for making international purchases, as they work in every currency. Many credit cards offer a concession fee for international purchases.

- Credit cards offer a line of credit for the users. Users can use the credit and can repay later.

- A credit card user can easily purchase costly goods with ease and can repay later in Installment.

- Credit cards also provide theft protection, insurance on accident, luggage, and even on death.

- A credit card will help you to track and manage your spendings.

Cons of Credit Card:

- Credit cards charge a high-interest rate on loans and can incur debt.

- If you missed any installment, it can affect your net credit score.

- It might increase your expenses. It can encourage overspending and unwanted purchases.

- Often people apply for too many credit cards, which can damage their net credit score.

- Annual fee, renewal fee on credit cards are additional expenses.

- There are many fraudulent activities targeting credit card data. Sometimes, it might be difficult to manage a credit card.

Credit cards can be a major financial tool if managed wisely. It can land you in trouble if you are a little careless in repaying the loan. You should only apply for a credit card if you can repay the loan on time and keep your credit score high. Credit cards can make you spend more and that could lead to financial problems.

While choosing a credit card. You can consider our recommendation of the 10 best credit cards for online shopping. After extensive research, you can select the credit card that suits your needs.

Frequently Asked Questions

How To Manage Your Credit Score?

Credit score determines your creditworthiness. A credit score might be useful and is something that lenders check before giving you a loan.

You can manage your credit score by paying your due on time or at least the minimum amount. Do not apply for too many credit cards as it can impact your credit score negatively.

What Are The 5 C’s Of A Credit Card?

The five Cs of credit are Character, Capacity, Capital, Collateral, Condition. These 5’c will determine your creditworthiness.

– Character is the applicant’s credit history.

– Capacity determines an applicant’s debt to income ratio. It is the monthly debt expenditure divided by your entire earnings.

– Capital is the total money an applicant has.

– Collateral is the security lent to the lender for the loan.

The 5th C, conditions, include the amount of loan, purpose for the loan, and time for repayment.

What Is The 20/10 Rule?

The 20/10 rule for credit cards says that your debt payment should be 20% of your annual income or 10% of your monthly income. With the 20/10 score, you can manage your expenditures, overspending, and credit score.

What Is A Credit Mix?

An ideal credit mix consists of both revolving credit and installment credit. It is the mix of loans and credit cards, or diversifying credit types.

For instance, If a person has two credit cards and no installment loan. He/she can open a loan. That will be a good credit mix.

What Is A Good Credit Score?

On Fair Isaac Corporation (FICO) score, any value above 670 is a good credit score. FICO score is a kind of credit score created by Fair Isaac Corporation.