If you want to transfer money from your bank account to someone else’s bank account, you need to add that person as a beneficiary in your account. Most bank customers are not aware that you cannot transfer funds immediately from your bank account if an individual is not on your beneficiary list. To transfer money to another person’s bank account, you need to add him/her as a beneficiary first.

Add Beneficiary In HDFC Bank Using Internet Banking

Steps to add beneficiary using HDFC Bank Net Banking:

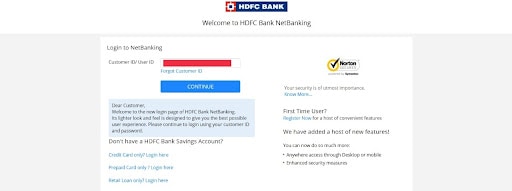

Step #1: Go to the official website HDFC Bank Netbanking.

Step #2: Log in to the websites providing your customer id, password.

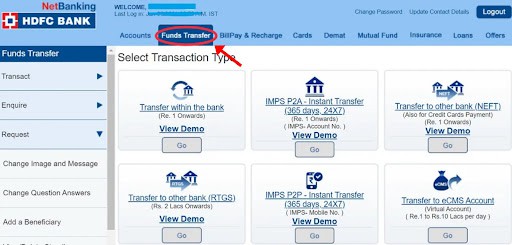

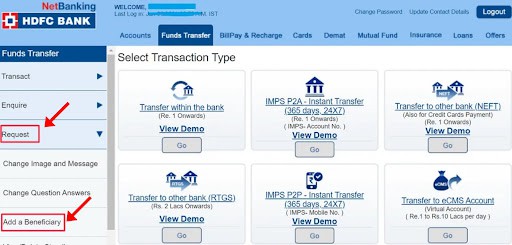

Step #3: Open the website and click on the “Fund Transfer” option.

Step #4: Select the “Add Beneficiary” then click on the new beneficiary.

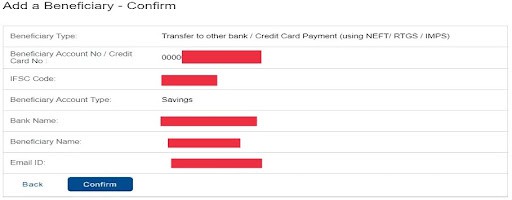

Step #5: The next screen will list the two options for beneficiary bank type. If your beneficiary is an HDFC bank account holder, then select the “Within the HDFC”, or your beneficiary is an account holder of the other bank, then go for the “Other Banks” option.

Step #6: The website will ask for the details of the beneficiaries/payees such as account number, IFSC code, bank name, nickname, etc.

Step #7: After verifying the data, click on the confirm button.

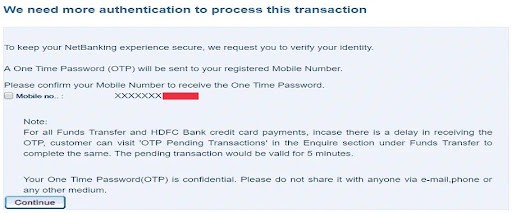

Step #8: Enter the OTP generated on your registered mobile.

Step #9: Tap the “Continue” button.

Step #10: The beneficiary will be added using the HDFC bank net banking.

Add Beneficiary In HDFC Bank Using Mobile Banking Application

Steps to add beneficiary using HDFC Bank Mobile Banking:

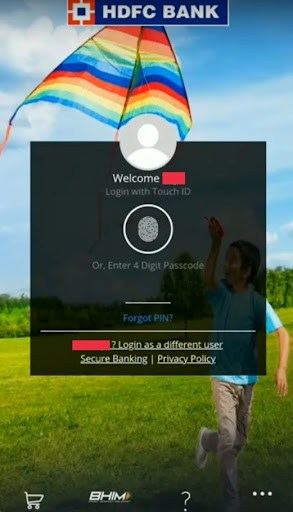

Step #1: Download and open the official HDFC mobile banking application.

Step #2: Enter your customer id, password and log in.

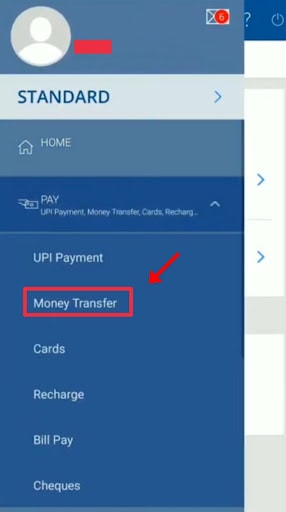

Step #3: From the menu bar, tap on the “Pay” option.

Step #4: Now, choose the “Money Transfer” option. A new screen will appear with a list of the banking options.

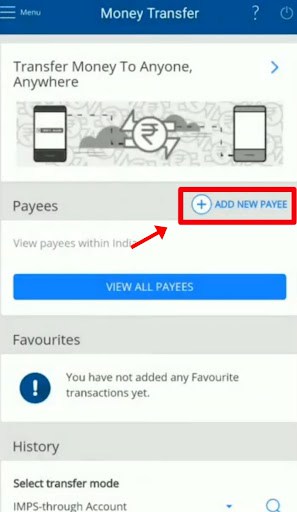

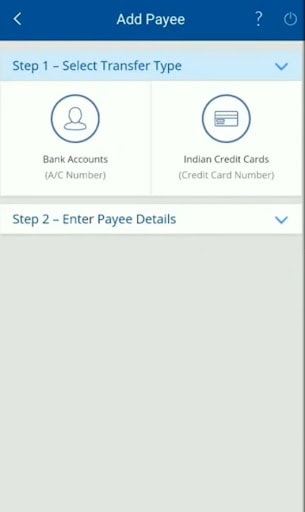

Step #5: Click on the “Add New Payee” option. Now, the application will list you two options under “Transfer Type”.

Step #6: If you want to add a bank account holder as a payee, then select the “Bank Account” option. The other option is for a credit card. Customers can even add a credit card as a beneficiary.

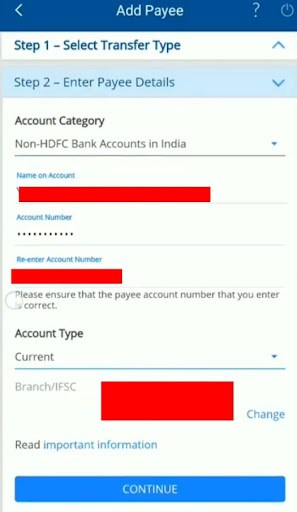

Step #7: In the next step, enter the beneficiary-related details including the bank name, IFSC code, nickname, account or card number, etc.

Step #8: You can choose the transfer type; for “HDFC Bank” or “Non-HDFC Bank account”.

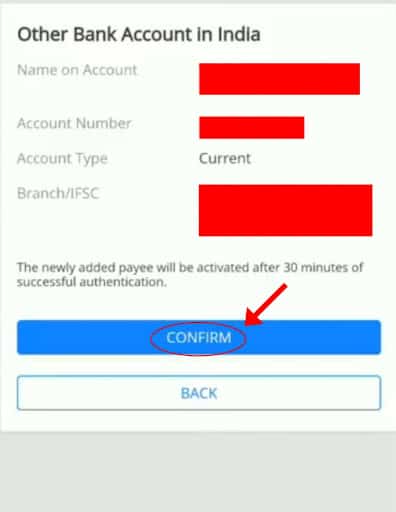

Step #9: Now, tap the “Confirm” button and verify your details.

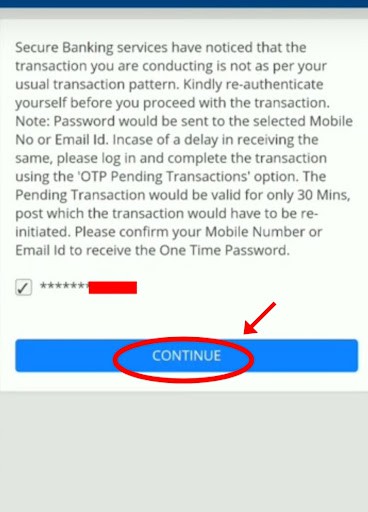

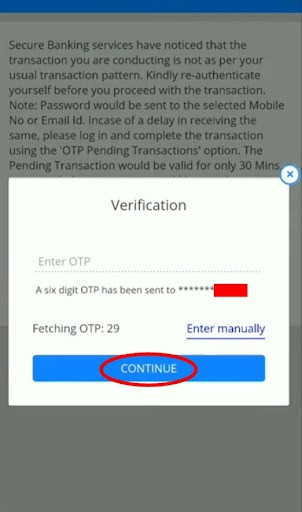

Step #10: Enter the One Time Password on the next screen. Your registered mobile number will receive the OTP.

Step #11: Tap on the “Continue” button and verify your OTP.

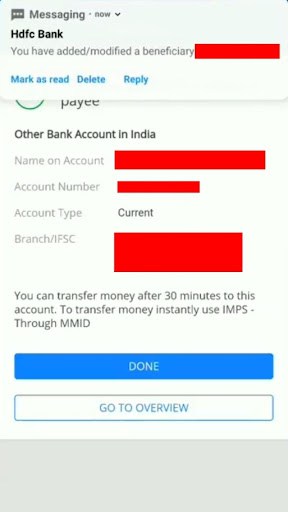

Step #12: After verifying, your beneficiary will be added.

HDFC Bank Beneficiary Activation Time

Due to security reasons, activation of the beneficiary in HDFC Bank will take place after 30 minutes. View the Beneficiary by selecting “View Beneficiary” from the Enquire Section. For the first 24 hours after beneficiary activation, payments up to Rs. 50,000 can be made (in full or in parts).

Recommended:

HDFC Bank Timings & Working Hours

HDFC Mini Bank Statement: Missed Call Number, SMS Banking

How To Close HDFC Bank Account?

Frequently Asked Questions

When Does The Beneficiary Get The Credit For An NEFT Transaction?

The NEFT transaction can be sorted out within 30 minutes to 4 hours.

If An NEFT Transaction Is Not Credited To A Beneficiary Account, Does The Payer Get A Refund?

If the beneficiary’s bank does not or is unable to credit the money in the beneficiary’s account, the money will be sent back to the payer’s account.

The money will be credited to the payer within two business hours.

Can We Transfer Money Without Adding Beneficiaries To The HDFC Bank?

Yes, HDFC bank customers can send money without adding beneficiaries. Customers can use the IMPS service and transfer money using Mobile Money Identification Number (MMID).

What Is The Beneficiary Activation Cooling Period In The HDFC Bank?

The cooling period is the time when the payer can not transfer the funds after the beneficiary activation up to a certain limit.

For HDFC bank, the cooling period is 30 minutes.

How Many Beneficiaries Can Be Added To The HDFC Bank Account?

The HDFC bank allows customers to add seven beneficiaries in a single calendar day.