The online banking facility of Axis Bank allows you to perform online banking transactions through your bank account. To avail of the online transaction service, customers need to add a beneficiary first.

If you want to add a new beneficiary to your axis bank account, you can consider the following step guide.

Who Is Beneficiary In Axis Bank Account?

A beneficiary is the receiver of the funds when a transaction is done. Beneficiaries can be an individual or can be a business entity.

Beneficiaries are added to the bank account to avoid the hassles of entering the payee data over and over again, each time the payer makes a transaction.

Add Beneficiary In Axis Bank Using Internet Banking

Steps to add beneficiary using Axis Bank Net Banking:

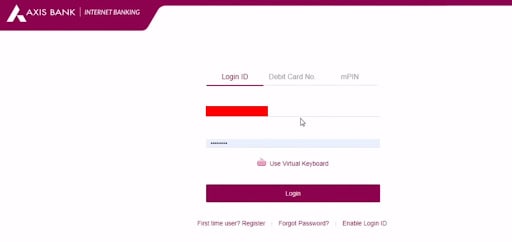

Step #1: Go to the official website of Axis Bank Netbanking.

Step #2: log in to the website. Enter your login details.

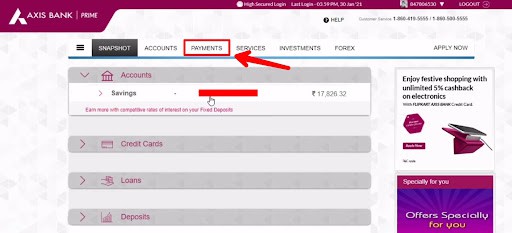

Step #3: In the menu section, select the “Payments” option.

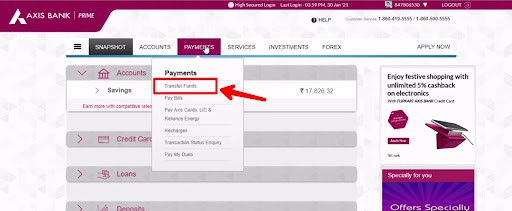

Step #4: Now, click on the “Transfer Funds” in the drop-down menu.

Step #5: Under the transfer funds options, select the type of transfer funds. If your payee is a customer of the Axis Bank then go for the “Axis Bank account”. If the payee is the customer of other banks, then click on the “other bank account”.

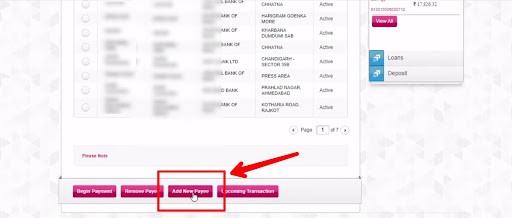

Step #6: Click on the “Add New Payee” button.

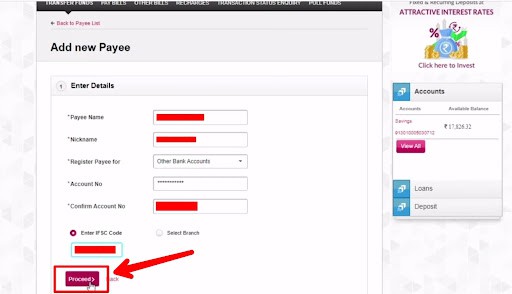

Step #7: Fill in all the details related to beneficiaries including their bank account number, nickname, account number, IFSC code, etc.

Step #8: Once you finish filling in the details, click on the “Proceed” button.

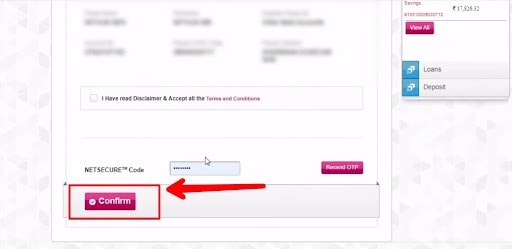

Step #9: After confirming your request, the bank will add your beneficiary.

Add Beneficiary In Axis Bank Using Mobile Banking

Steps to add beneficiary using Axis Bank Mobile Banking:

Step #1: Download and open the Axis Bank mobile application.

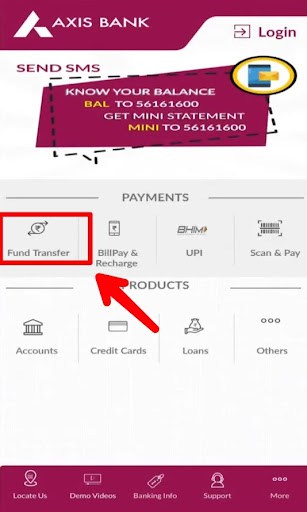

Step #2: Click on the Payment section and select “Transfer Funds”.

Step #3: Enter your MPIN code to access the service.

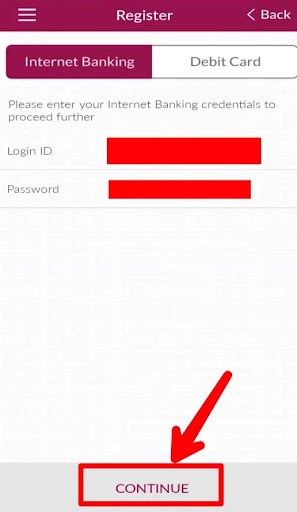

Step #4: Now enter your Internet banking details and tap on the “Continue” button.

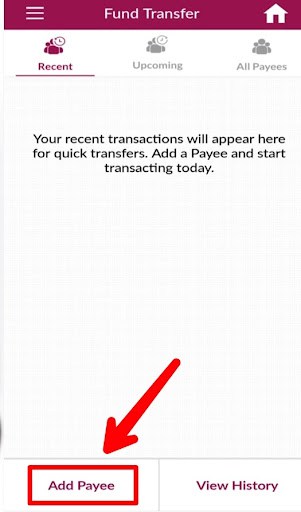

Step #5: Select the “Add Payee” option.

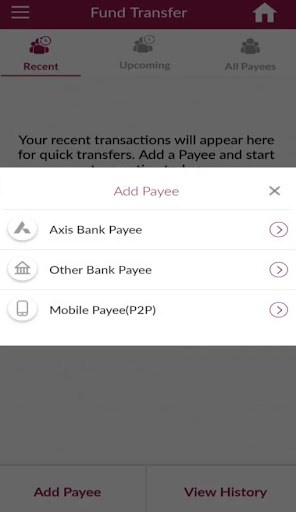

Step #6: Select the beneficiary type.

- If the beneficiary holds an account in the Axis bank, then select the “Axis Bank” option.

- If the beneficiary holds an account in a different bank, then select the “Other Bank” option.

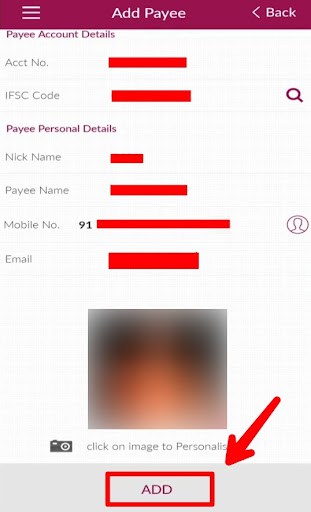

Step #7: On the next screen, enter the beneficiary details including the beneficiary’s account number, nickname, MMID, bank’s IFSC code, etc.

Step #8: Verify the details and click on the “Add” button to proceed.

Step #9: The bank will send you a ‘One Time Password’ on your registered mobile number. Enter the OTP.

Step #10: In case, you did not receive the OPT, or it expired. Click on the “regenerate OTP” to get a new one.

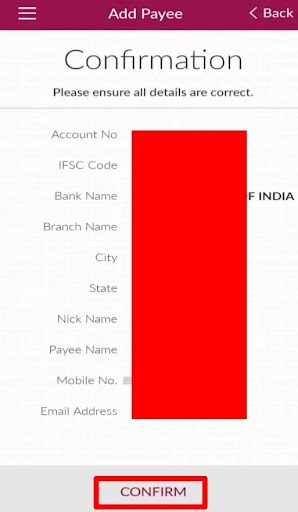

Step #11: Hit the “confirm” option.

Step #12: Your beneficiary will be added Successfully.

Add Beneficiary In Axis Bank Using Axis Bank ATM

Steps to add beneficiary using Axis Bank ATM:

Step #1: Visit your nearest Axis ATM.

Step #2: Insert your debit card in the ATM.

Step #3: Go to the payment section and choose the “Fund Transfers” option.

Step #4: Select the “IMPS” option.

Step #5: Enter all the IMPS-related information including beneficiary name, nickname, account number, branch name, and bank’s IFSC code.

Step #6: Complete your IMPS beneficiary process and choose the “Registration” option.

Step #7: Enter all the details and provide your registered mobile number.

Step #8: Verify your registered mobile number.

Step #9: Enter the OTP in the machine.

Step #10: Your beneficiary addition request will be fulfilled shortly.

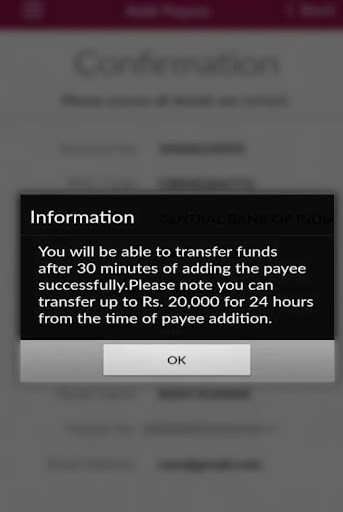

Axis Bank Beneficiary Activation Time

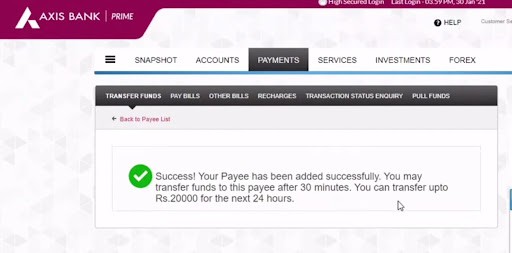

In most cases, this process takes a substantial amount of time since one must wait for a minimum of 30 minutes for the beneficiary to be activated in Axis Bank.

Recommended:

How to Delete Beneficiary in Axis Bank?

Axis Bank Mini Statement: Missed Call Number, SMS Banking

How To Close Axis Bank Account?

Axis Bank Timings & Working Hours

Frequently Asked Questions

How Long Does Axis Bank Take To Add A Beneficiary?

Axis bank takes about 30 minutes to register a new beneficiary. If it is taking more time, customers may contact the bank.

What Are The Hours For The Transaction To The Beneficiary In Axis Bank?

Transactions to the beneficiary can be made on a 24*7 basis. The process is real-time.

Can Axis Bank Customers Do IMPS Without Adding A Beneficiary?

IMPS service can not be used without registering a beneficiary.

What Is The Duration Of The Cooling Period In Axis Bank?

Ans: the cooling period is the period when the payer is unable to make a transaction to a recently added beneficiary account.

In Axis Bank, the cooling period lasts 30 minutes.