When it comes to navigating the intricacies of taxes and government agencies, it’s no surprise that many people can find themselves feeling lost or confused.

One area that can be particularly challenging to understand is the IRS transcript, a document that summarizes an individual’s tax account.

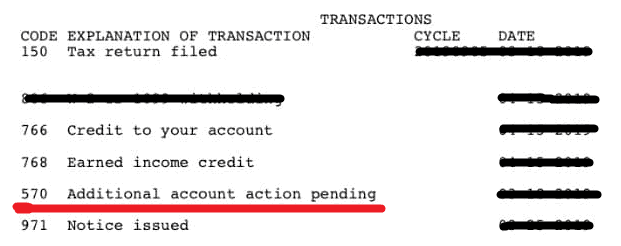

One of the more mysterious entries on an IRS transcript is the “570 Additional Account Action Pending” code.

What does this code actually mean? In this blog post, we’ll explore the possible reasons for this code, what actions the IRS may take, and what steps you can take if you see this code on your transcript.

Understanding this code can help you stay informed and proactive when it comes to managing your taxes and dealing with the IRS.

What Does 570 Additional Account Action Pending Mean On The IRS Transcript

The “570 Additional Account Action Pending” code on an IRS transcript indicates that the IRS has taken some action or is planning to take some action on the taxpayer’s account.

However, the specific action that the IRS is taking or planning to take is not disclosed on the transcript.

This code can appear on a transcript for a variety of reasons, including an examination or audit of the taxpayer’s account, a freeze on the account due to suspected fraudulent activity, or a review of the taxpayer’s installment agreement.

When the “570” code appears on a taxpayer’s transcript, it typically means that there will be a delay in the processing of any refunds, as the IRS is taking additional action on the account.

Taxpayers who see this code on their transcript should be prepared to wait for further communication from the IRS, as they may receive a notice in the mail outlining the specific action the IRS has taken or plans to take.

There can be a few reasons why you might be seeing a Code 570:

1. Mismatched Report About Wage And Third-party Income

If there is a discrepancy between your reported wage and your 3rd party income then IRS will have to look thoroughly before they can process your tax.

2. Identity Verification

Sometimes IRS will try to verify your identity thoroughly before going with the refund procedure.

3. Tax Credits

Certain tax credits will be reviewed much more thoroughly than others which will take more time by IRS.

To sum up, if you see a “570 Additional Account action pending” in your tax transcript then there is no need to worry.

You will get your refund but you may have to provide additional information to IRS for which they will contact you.

The timespan might become a bit long but you will get your money back as soon as IRS is finished with the proceedings.