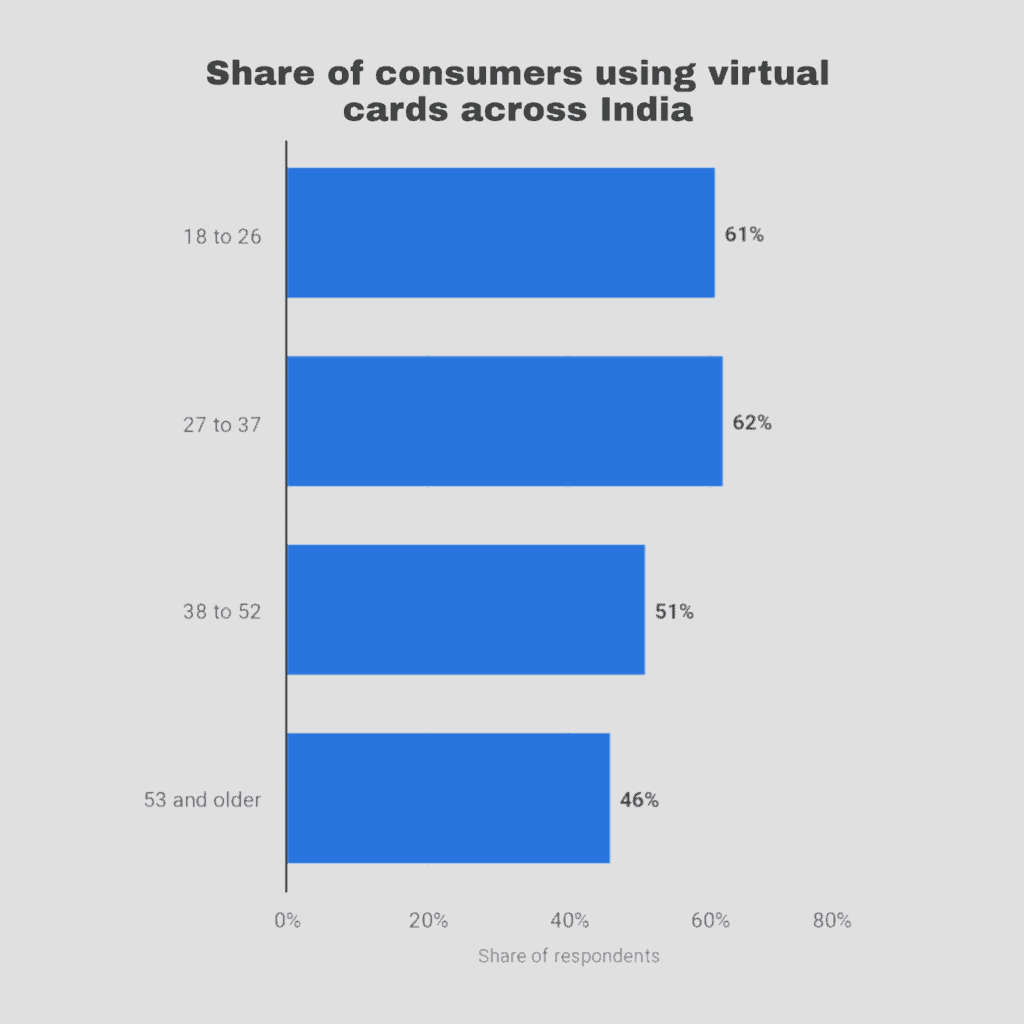

Online payment systems are steadily changing in the country. From net banking to UPI, the contour of money transactions has changed significantly. In addition, virtual credit cards in India are gaining a lot of traction. There are many questions about them – the most popular one is the best virtual credit card in India.

Which virtual credit card should be used for international transactions? Virtual credit cards provide you a safe and secure way to transact online. They can be an excellent alternative to transactions through regular physical credit cards.

We will focus on the top 10 virtual credit cards in India that have performed well in the recent past.

Top 10 Virtual Credit Cards In India

1. HDFC NetSafe Card

HDFC NetFace is the banking service provided by HDFC bank to create a virtual card with your HDFC credit card number. It can be used for online shopping. It provides you with high security while shopping. This is a one-time use card. HDFC is one of the best virtual credit card in India.

A cardholder can generate up to five virtual credit cards per day. The card has an expiration duration of two days. The amount limit of the credit card present on the amount the cardholder has deposited. After expiring, the remaining amount is credit back to the primary source, aka the cardholder’s account. Cardholders can set the amount list as per their choice.

Every online store accepts NetSafe virtual credit cards that use VISA/Mastercard cards. Like a regular credit card, purchases made with virtual credit cards will reflect on your bank statement.

No fee is required for generating the virtual credit card.

2. SBI Virtual Credit Card

The E-card or virtual SBI credit card issued by the SBI provides you a safe and secure way of online shopping at a merchant website. SBI Virtual credit card is accepted at every store that accepts VISA/Mastercard. SBI Virtual credit card is valid for up to two days. The card will be canceled if not used. It is effortless to generate SBI virtual cards by just using Internet Banking.

Cardholders can generate cards with a minimum amount of ₹ 100 and the maximum amount of ₹ 50,000. It is a one-time used card. Cardholders can transact in three countries, India, Nepal, and Bhutan with using the card.

Cardholders can generate an unlimited amount of cards in a day. After expiration, the remaining money will be credited to the user. There is no issuance fee for the virtual credit card.

3. LazyPay Virtual Credit Card

LazyPay is a credit platform powered by the PayU payment portal. Users can use LazyPay to purchase goods at the merchant’s website. Users can borrow up to ₹ 1 lakh. The loan amount depends on the individual’s cibil score. The virtual credit card can be accessed even if you do not own a credit card. However, users need to complete the KYC process to access the credit benefits. LazyPay is one of the best virtual credit cards in India.

It allows users to repay money into EMIs for purchasing from Flipkart, MakeMyTrip, and other partners.

4. EcoPayz Virtual Credit Card

ecoPayz is a virtual credit card powered by the Mastercard gateway of payment. ecoPayz presents one of the most secure and safe ways of online transactions. ecoPayz credit card is available in 8 currencies. It offers a pan world service. Users can spend the money worldwide wherever Mastercard is accepted. ecoPayz is among the best virtual credit cards in India.

The card can not be stolen or lost as all credit card data is virtual and blocked after one use. No fee is required for generating the virtual credit card.

It can be issued to anyone and doesn’t require a bank account. It provides an easy and quick applying process. ecoPayz credit card can be used for online transactions. Users can enable or disable the credit card via the ecoPayz application. There are no minimum spends and no pre-set amounts on the card.

5. ICICI Bank Virtual Credit Card

ICICI bank virtual credit card is an E-card, generally issued for online transactions. The e-card is issued on the physical cards of the applicant. The digital credit card is safe and secure. The credit card is convenient and easy to use. No fee is required for generating the virtual credit card. Cardholders can use it to make international transactions. It is among the best virtual credit cards in India.

ICICI virtual credit card offers various deals and discounts on the credit card. On every ₹ 200 spent, users are rewarded with one reward point. The bank charges no fee for the credit card. The virtual credit card can be issued to banks or people with a good credit card score. The bank only allows making online purchases using the virtual credit card.

6. Axis Bank Freecharge Plus Credit Card

This Axis Bank Freecharge Plus credit card is a virtual cum physical credit card. The virtual card has no joining fee. Users can enjoy features of both physical and virtual credit cards on the same card. Only Freecharge users can get the card. Axis Bank Freecharge Plus Credit Card can be generated via the Freecharge application.

Users can earn EDGE reward points with the virtual card. EDGE reward points are the loyalty points given by the Axis bank on completing milestones with the bank. The card offers 100 reward points on spending over ₹ 2000 and 250 points on spending over ₹ 5000.

The virtual card gives you the experience of the credit card. You can avail the benefits of both physical and virtual credit cards. It offers you several other rewards like cash back and gift vouchers.

Recommended: Best Forex Cards in India

7. Kotak NetC@rd

The Kotak Netc@rd is one of the best virtual credit cards in India issued by Kotak Mahindra Bank. The card is a one-time use credit card with an expiration period of two days. Users can load money into the card via net banking. Kotak Netc@rd is accepted worldwide. It can be used to access free trials of OTT platforms. Every merchant website that accepts VISA cards will accept the Kotak Netc@ard. Kotak Netc@rd is among the best virtual credit cards in India.

No fee is required for generating the virtual credit card. The bank gives a fantastic offer to the user that they can generate the credit card with a zero balance account, but they need to complete the KYC process first. Users can create virtual credit cards using Aadhar cards and PAN cards.

8. Ewire Virtual Credit Card

Ewire is a virtual credit card India (VCC) with auto-expire and CVV. Users can get a credit card via Ewire mobile application. The credit card offers several benefits and discounts on spending at selected merchant websites. Ewire Virtual credit card is convenient and easy for billings and shopping. Cashier, a fintech company, powers Ewire Virtual credit card.

The credit card offers you other services like RechargeEwire that allow you to access various online recharges (Prepaid and Postpaid) and money transfer facilities. Ewire provides cash withdrawal facilities from ATMs. No fee is required for generating the virtual credit card.

9. Slonkit Prepaid Credit Card

Slonkit Virtual Prepaid Credit Card is an innovative digital wallet that provides you free virtual credit cards powered by the VISA payment gateway technology. The virtual credit card is backed by DCB bank. Users will get all the offers given by DCB bank. The virtual credit card can be managed by the money management application on your smartphone. No fee is required for generating the virtual credit card.

Users can track and manage their spendings and expenditures. Slonkit Prepaid Credit card is suitable for kids; parents can monitor the transaction activities from their smartphones. This credit card can be the best way to teach money management to your child.

Recommended: The Ultimate Guide to Credit Card Churning

10. Udio Virtual Rupay Credit Card

Udio Virtual Rupay credit card is backed by RBL bank. The VISA gateway technology powers the credit card. Udio Rupay credit card is the best virtual credit card for teens. Users can deposit money using their net banking or credit card. No fee is required for generating the virtual credit card.

It also offers facilities to transfer money in the bank account. Udio also offers various deals and rewards on online spendings. Users can avail all the benefits given by RBL bank.

There is a limit of transactions up to 20 transactions per day and 100 transactions per week.

Pros And Cons Of Virtual Credit Cards

Pros Of Virtual Credit Card:

- Virtual credit cards provide you a safe and secure way for online transactions. If a user falls victim to fraudulent activity, his data and money from the actual credit card will be safe.

- Another advantage of virtual credit cards is that the actual credit card account number is not visible to the merchant or online payment system. Fraudsters cannot use this information to commit any other online fraud.

- The generated credit card is valid for one-time online purchases only, which lowers the chances of theft. After completing transactions or their period, virtual credit cards automatically expire.

- Users can set a limit of transactions on the virtual credit card. Users can connect the virtual credit card and add the amount of money as their needs.

- Users can make online purchases or transactions as they wish. The advantage of a virtual credit card is that the merchant place widely accepts it.

- Another advantage of virtual credit cards is their wide availability. Anyone can generate virtual credit cards.

- Credit cards give freedom to online shoppers. Virtual credit cards allow them to shop online from anywhere in the world.

- Virtual credit cards give you rewards and cashback in the same manner as physical credit cards do.

- A lot of online platforms and websites do not accept debit cards. If the user does not have a credit card, they can use the virtual credit card.

- Users can disable the card at any time.

Cons of Virtual Credit Card:

- They are less user-friendly than other popular transactions like UPI and swipe machines.

- Cash withdrawal facility not available for some virtual credit cards.

- Still, some merchants do not accept payments via virtual credit cards.

Frequnetly Asked Questions

Are Virtual Credit Cards Legal?

Yes, virtual credit cards are legal in India. Various prestigious banking institutions like Axis bank, HDFC bank, and SBI bank also provide options to generate virtual credit cards at no issuance fee.

Do Virtual Credit Cards Affect Credit Score?

No, applying for a virtual credit card does not affect your credit score. Virtual cards are separate entities issued by institutions. Therefore, owning a virtual card will not hurt your credit card score.

Which Is The Best Virtual Credit Card For OTT Platform Trails?

Kotak Netc@rd and HDFC NetSafe credit cards may be the best choice to access accessible subscription trails of various OTT platforms like Netflix, Amazon Prime Video, Hotstar, etc.

Can Users Block Their Virtual Credit Card Online?

Yes, cardholders can block their virtual credit cards online. They can request their banks to block the card, or they can block themselves using the mobile application of the particular credit card issuer.

How Is A Virtual Credit Card Safer Than A Regular Physical Credit Card?

The details of your credit card are more crucial and prone to any fraudulent activity. Using physical credit for online shopping can be risky as merchants’ websites can store and view your credentials. Using a virtual credit card for online transactions can lower the risk as it does not include any information about your primary credit card.