Indeed, technology is improving every aspect of business planning. Then how could the finance industry remain untouched by it? The financial system has certainly improved a lot. This blend of finance and technology is making our lives easier.

FinTech or Financial Technology is an integration of technology and finance.

Today, all smartphones have mobile banking installed to perform all our banking transactions wherever we are.

The impact of fintech startups has been significant on the economy. It also brought about fundamental changes in how payments are made. The payment system has transformed the way we do business. These top FinTech companies in India are making waves in the finance industry and reaching out to different markets with unique financial services.

Top 12 FinTech Startups In India

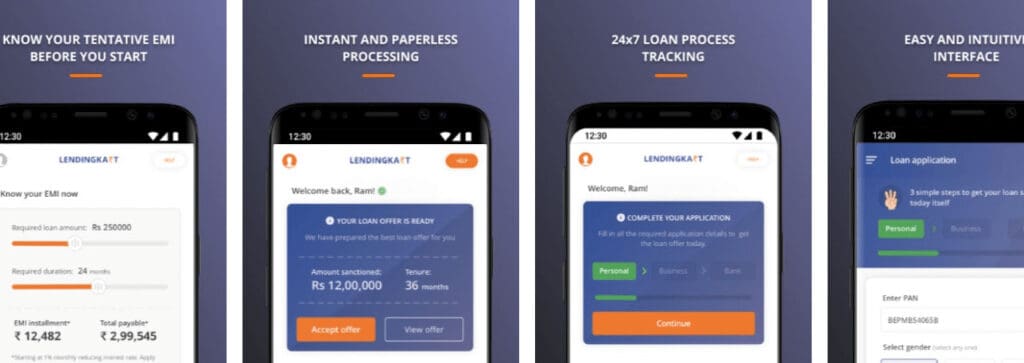

1. Lendingkart – Easy Business Loans

Lendingkart is one of India’s most popular fintech startups. It was founded by Harshvardhan Lunia and Mukul Singh in 2014. Lendingkart offers capital loans to small- and medium-sized businesses in the amount of Rs. From Rs.50,000 up to Rs. 35 Lakhs.

The loans are granted quickly and don’t require collateral(Security submitted as a loan repayment guarantee).

Lendingkart’s mission is to provide capital financing so that entrepreneurs can concentrate on their businesses and not worry about cash flow. Lendingkart was included in the KPMG Fintech 100 list for 2018.

In February 2018, the company raised 76 million US dollars. has raised a total of $ 257.5 million to date. Lendingkart is expecting to expand its business in 12,000 cities.

Recommended: Top 8 Reasons For Startup Failure In India

2. MoneyTap – Personal Loan & Credit Line App

MoneyTap offers an app-based credit line. Anuj Kacker and Kunal Verma founded the company in 2015. MoneyTap offers low to medium interest rates on cash loans, as well as EMIs and fast cash loans. The app can be accessed with a smartphone and PAN.

In 15 minutes you can check your qualifying limit for a loan. The loan processing is completely paperless and comparatively fast. The best thing about interest rates is that they only affect the amount you borrow, not your total limit.

MoneyTap works only with RBI-supervised, regulated Indian financial institutions. It reviews customer information to determine eligibility and decides on the credit limit.

The company has raised a funding amount of $ 40.3 million in two funding rounds. The company is backed by investors like Prime Venture Partners, MegaDelta Capital, and RTP Global.

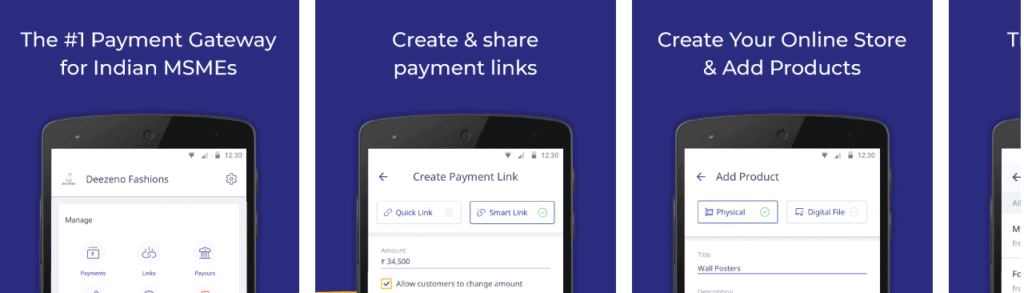

3. Instamojo – Business App For MSMEs In India

Sampad Swain and Akash Gehani founded Instamojo in September 2012. Instamojo does not charge fees and offers free online shopping. To help grow your business, you can ship products, get loans, and many other services.

Startups and micro-entrepreneurs use Instamojo to create, market, manage and grow their businesses instantly.

We offer a range of services, including online payments, logistics, credit, and finance, as well as a variety of other services via mobile or web platforms.

Instamojo provides personalized business tools and guides for the growth of the business. MojoCapital is a Mojojo product that allows you to distribute short-term credit loans of less than Rs 2,000,000.

Instamojo has raised a total of $ 423.2 million to date.

Recommended: How to Start a Business in India

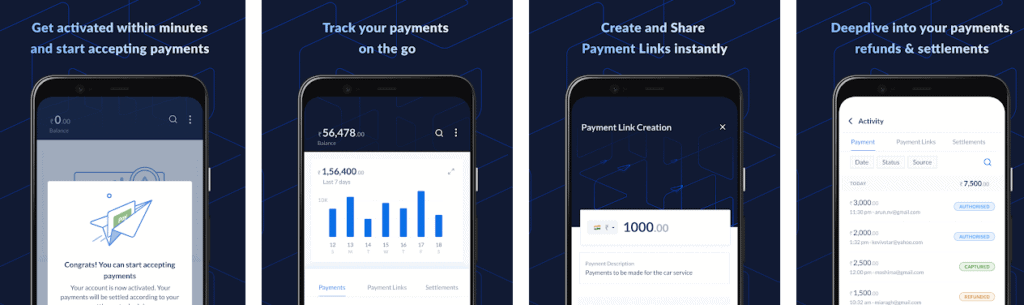

4. Razorpay – Accept Digital Payments & Track Sales

Razorpay is a payment platform for India. It has become a key payment option for businesses. Razorpay was founded in 2014 by Harshil Mathur and Shashank Kumar.

Businesses can manage their marketplace from one platform. It is a payment system that avails credit card payment, online transactions, credit card, debit card, net banking, UPI, and popular wallets including Airtel Money, FreeCharge, JioMoney, Mobikwik, Ola Money, and PayZapp.

Razorpay has launched other services like Razorpay X, Razorpay capital, and Razorpay Capital. It is one of the top fintech companies.

The company has raised a funding amount of $ 366.6 million in seven funding rounds. It is funded by 29 investors such as Tiger Global Management, Ribbit Capital, Matrix Partners India and GIC.

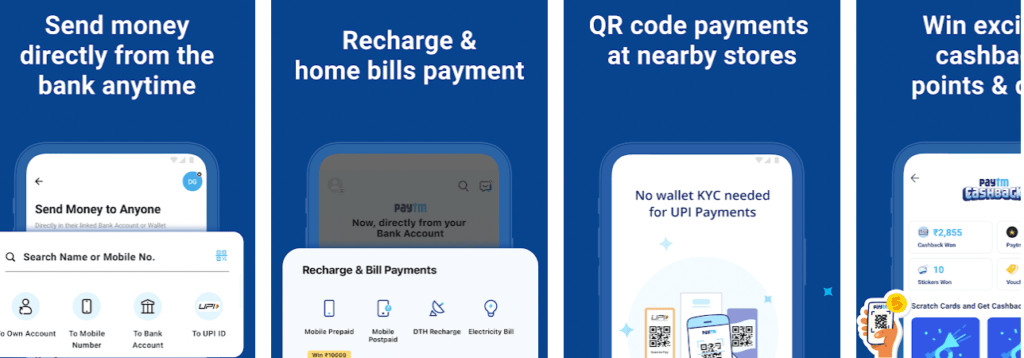

5. Paytm – UPI, Money Transfer, Recharge, Bill Payment

Vijay Shekhar Sharma founded Paytm which is owned by One97 Communications. Paytm has been authorized by the RBI. Paytm has many partners, including Uber, BookMyShow, and Foodpanda. Softbank, Ant Financial, and SAIF Partners are just a few of the investors.

IRDAI has granted a brokerage license to Paytm Insurance, a wholly-owned subsidiary of One97 Communications Ltd. (OCL).

“Paytm Kro” is a well-known phrase. This tagline is being used all over India. Paytm also includes investors like Alibaba Group, SAIF Partners, and Art Financial. Paytm is India’s most well-known mobile commerce platform. It began by offering mobile recharge services and utility bills payments.

Grocery and Fruit shops, Vegetable shops, restaurants, Tolls, Tolls, and Pharmacies are all included in the in-store payment.

Vijay Shekhar Sharma founded Paytm in 2009. It is India’s one of the most valued unicorn startups. Paytm now boasts more than 350 million users and has raised $4.4 billion in funding.

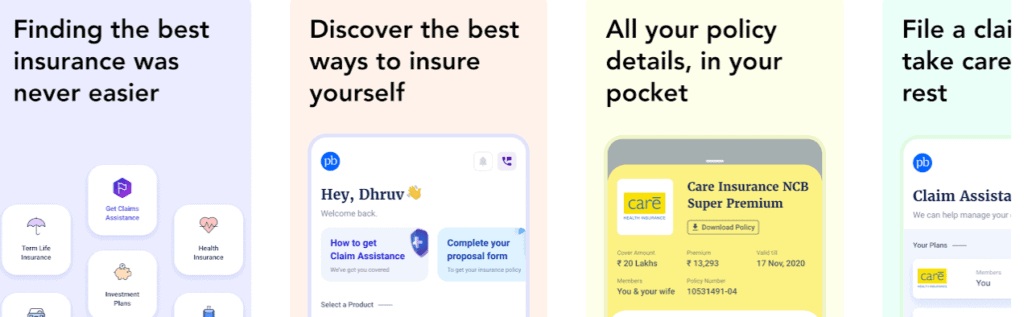

6. Policybazaar – Compare & Buy Insurance

Policybazaar.com is India’s largest and most trusted insurance broker. It also ranks among the best fintech players in the world. Initially, Policybazar was started to provide price information on insurance and related programs.

Later, Policybazar started selling online insurance. It also collects revenue for advertisements and promotions. Alok Bansal, Avaneesh Nirjar, and Yashish Dahiya founded PolicyBazaar in Gurugram in June 2008. Users can compare different insurances provided by different financial institutions. More than 3 lakh transactions are done on the platform.

KPMG listed the website as one of the 100 most innovative Global fintech firms in 2018.

Policybazar has raised $ 257.7 million in funding, to date. Currently, 22 investors fund Policybazar. The company is invited by Tencent, Cyrus Poonawala Froup, Falcon Edge Capital, White Oak Global Advisors, and other top firms.

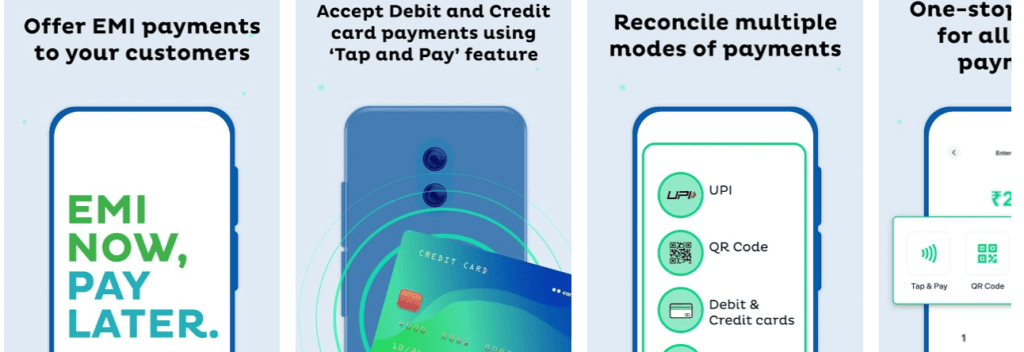

7. Pine Labs For Business: EPOS,UPI, EMI

Pine Labs was founded by Rajul Garg and Lokvir Kapoor in 1998. Pine Labs is a merchant platform and also develops Fintech software.

It provides services like Instant EMI, Loyalty Solutions, Instant Discounts, Cashback Programs, Dynamic Currency Conversion, PaybyPoints, eWallet, Targeted Promotions, and many more. It allows NFC payments, last miles payments. In 2019, CNB named the company as one of the top 10 highest-funded startups in India.

The company makes Point-of-sale software. It has a 10% share of India’s PoS market and about 300,000 PoS in India. More than 100,000 Indian merchants use Pine Labs technology. The company serves in the Middle East, Southeast Asia, and the Middle East. Pine Labs has raised a total of $ 423.2 million to date. Companies like Mastercard, Duro capital, Baron Capital and Marshall Wace fund Pine Labs.

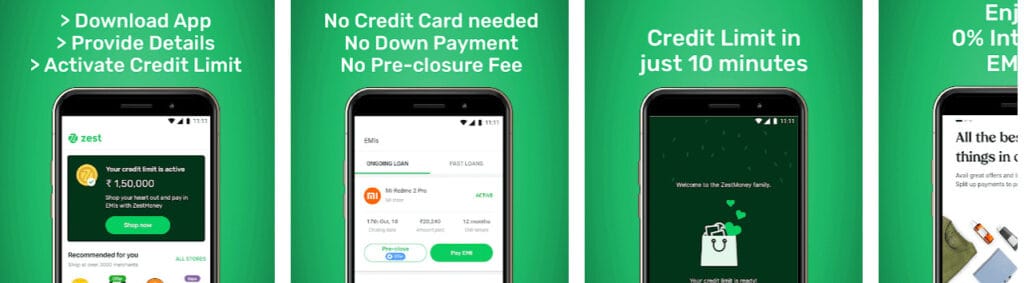

8. ZestMoney – Shopping On EMI Without Credit Card

ZestMoney is an Indian startup founded by Ashish Anantharaman & Lizzie Chapman. It is one of the most innovative Fintech platforms. ZestMoney uses artificial intelligence with payment technology and mobile banking. It provides instant loans and EMI services.

ZestMoney was named the 2020 Technology Leader at the World Economic Forum for its innovative technology and efforts. Zest Money is among the top fintech companies in India. To date, ZestMoney has raised a total of $ 68.4 million in funding.

ZestMoney was financed by international investors such as MI, Ribbit, Naspers, and Flourish Capital.

Recommended: Best Profitable Franchise In India

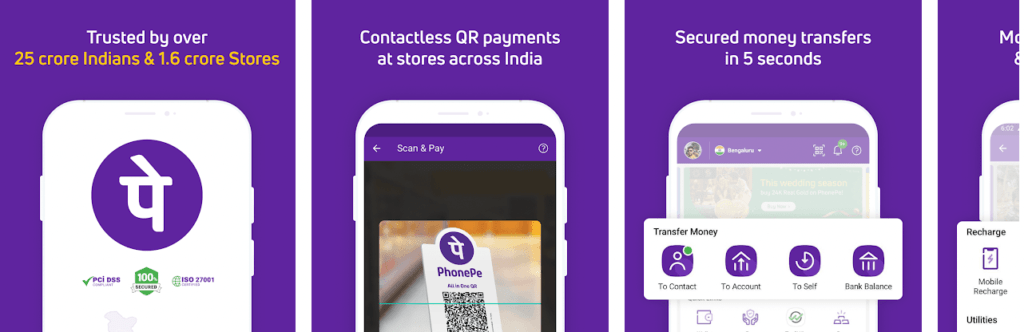

9. PhonePe – UPI, Recharge, Investment, Insurance

PhonePe was founded by Sameer Nigam and Rahul Chari in 2015. The mobile payment platform is owned by Flipkart. PhonePe is among the top fintech companies in India with more than 280 million users.

The app cloaked over 1.3 billion transactions in April 2021. The UPI-based payment platform provides services such as Digital payments, Financial services, Advertising Merchant payments, investments, and many more. It is also available in eleven other languages. It is funded by Flipkart and Walmart.

PhonePe has managed to raise $1.2 billion to date.

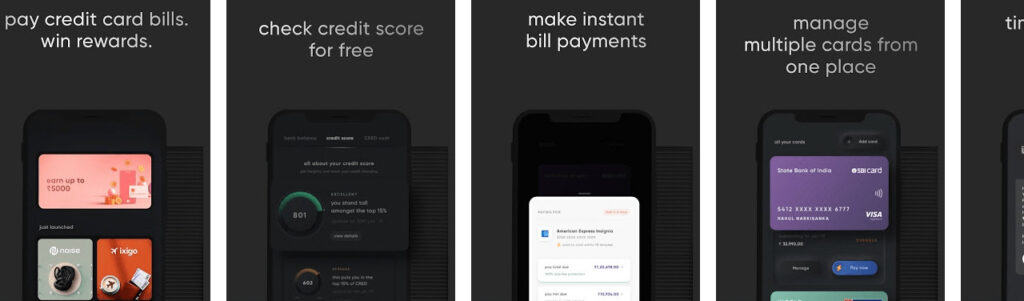

10. CRED – Credit Card Bills, Rewards, Free Credit Score

CRED is a unicorn Indian startup founded by Kunal Shah in 2018. It provides credit card management and payment services.

CRED provides services such as credit card payments; rewards as offers and discounts on shopping, health services, and other sites; house rent payments, and flexible instant short-term credit lines at low interest.

The company has raised a funding amount of $ 471 million in six funding rounds. It is backed by 28 investors. Dragoneer Investment Group, Falcon Edge Capital, RTP Global, Tiger Global Management, Greenoaks Capital, and Sofina are the most recent investors that funded CRED.

11. Shiksha Finance

Shiksha Finance is one of the largest education banking moneylenders. It was founded by Jacob Abraham in 2014. Shiksha Foundation provides loans in the education sector for asset building, property purchases, educational loans, and building construction.

Shiksha Foundation lends money to low-income students, and schools that face a lack of funds to expand their property, classrooms, etc. To date, the company has lent 84653 study loans.

Shiksha Finance has raised a total of $ 29 million to date. Shiksha Foundation is funded by companies like Aspada, Northern Arc, Zephyr Managemen and Triodos Investment Management.

12. Capital Float

Gaurav Hinduja and Sashank Rishikhasringa founded the company, Capital Float. It was formerly known as Zen Lefin Private Limited.

Capital Float is one of the largest digital lenders in the country. It has granted loans of more than ₹ 9000 Cr to over 2 million customers. It provides fast processed loans to Small and Medium Enterprises.

The company has raised total funding of $154 million. It is funded by the likes of Amazon, Rabbit Capital, Triodos Investment Management, and SAIF Partners.

Top 12 FinTech Startups In India – Comparision

*Do not consider this tabular format as the ranking of any particular company. The data cited is of July 2021. Considering that the market is dynamic, data may vary.

| Sr. No. | FinTech company name | Founded In | Founded By | Total funding raised | Services and products |

| 1. | Lendingkart | 2014 | Harshvardhan Lunia and Mukul Singh | $ 257.5 million | capital loans to small and medium-sized businesses |

| 2. | MoneyTap | 2015 | Anuj Kacker and Kunal Verma | $ 40.3 million | cash loans, EMIs |

| 3. | Instamojo | 2012 | Sampad Swain and Akash Gehani | $ 423.2 million | online payments, logistics, credit, and finance |

| 4. | Razorpay | 2014 | Harshil Mathur and Shashank Kumar | $ 336.6 million | credit card payment, online transactions, credit card, debit card, net banking, UPI and popular wallets |

| 5. | Paytm | 2009 | Vijay Shekhar Sharma | $4.4 billion | Online transaction, e-commerce, retail, and utility bills payments |

| 6. | Policybazar | 2008 | Alok Bansal and Yashish Dahiya | $ 257.7 million | online insurance-related services |

| 7. | Pine Labs | 1998 | Rajul Garg and Lokvir Kapoor | $ 423.2 million | Instant EMI, Loyalty Solutions, Instant Discounts, Cashback Programs, Dynamic Currency Conversion, PaybyPoints, eWallet, Targeted Promotions |

| 8. | Zest Money | 2015 | Ashish Anantharaman and Lizzie Chapman | $ 68.4 million | payment technology and mobile banking |

| 9. | PhonePe | 2015 | Sameer Nigam and Rahul Chari | $1.2 billion | Digital payments, Financial services, Advertising Merchant payments, investments |

| 10. | CRED | 2018 | Kunal Shah | $ 471 million | credit card payments, house rent payments, short-term credit lines at low interest |

| 11. | Shiksha Foundation | 2014 | Jacob Abraham | $ 29 million | loans in the education sector for asset building, property purchases, educational loans, building construction |

| 12. | Capital Float | 2013 | Gaurav Hinduja and Sashank Rishikhasringa | $ 154 million | Digital loans |

Final Thoughts – Key Takeaway Points

This list of top fintech startups will give you an insight into understanding the economic changes and looking for top fintech companies in India.

Fintech has changed the way the banking system works for good. In 2021, India completed its 30 years of economic reforms initiated by former Finance Minister Dr. Manmohan Singh in 1991.

Since then, India has witnessed rapid growth in the economic sphere. Foreign companies and banks have entered the Indian market. From the introduction of ATMs to Fintech, foreign bodies have given the Indian markets some incredible stuff.

Frequently Asked Questions

What Does A Fintech Company Do?

Fintech stands for Financial Technology. Fintech companies deliver better banking and financial services to companies, businesses and clients using specialized software. They offer services like digital payments, personal finance, management, P2P lending, and many more.

How Many Fintech Companies Are There In India?

Approximately, there are 2565 Fintech companies in India which is one of the highest numbers in the world.

Why Is Fintech The Future In India?

Fintech companies are providing better financial support to consumers. Integrated financial services with technologies like artificial intelligence, better software and algorithms are making work easier than ever. With the advancement of technology, fintech will accelerate its development.

Is Fintech Regulated In India?

All fintech companies fall under the purview of the Reserve Bank of India. RBI has handed out all the rules and regulations for Fintech companies in India.

Are Investors Betting On Fintech?

Yes, investors and venture capitalists are funding these companies. Global investors like Tiger Global Management, Rabbit Capital Falcon Edge Capital are funding million dollars in Fintech companies. Top Fintech companies in India like Paytm and Phonepe have managed to raise billions of dollars.