There are different kinds of debit cards offered by Indian Banks for their customers. But, do you know what the various types of Indian Bank debit cards and their benefits are? This article will learn about the types of Indian bank debit cards and their major benefits to the customers of holding its different cards.

But before discussing the types, benefits, and other advantages of Indian Bank credit cards, you must know what debit cards and their uses are.

What Are Debit Cards Or ATM Cards?

A debit card is also called an ATM card which is a plastic or metal card issued by financial institutions to transfer money electronically or withdraw cash by visiting any ATM without visiting the bank. The fund’s transfer process through debit cards is card to card, electronically safe and secured.

You can also use your debit cards for shopping online or offline as you don’t require to carry cash as most shopping centres have ATM swipe machines. You only need to swipe your card over the small electronic machine and enter your 4-digit passwords to successfully transfer funds from your Debit card to the shopkeeper’s account.

Indian Bank Debit Cards

While talking about Indian bank debit cards, there are mainly 9-variants of debit cards which includes:

- RuPay Platinum Card

- RuPay Debit Select Card

- IB DIGI – RuPay Classic Card

- PMJDY (Pradhan Mantri Jan Dhan Yojana) Card

- MasterCard World

- E–purse Master card

- Senior citizen cards

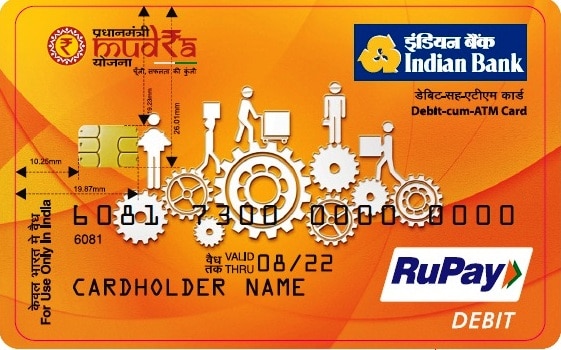

- MUDRA Card (Micro Units Development and Refinance Agency)

- IB Surabhi Platinum Card

These all nine variants of cards have the facility to withdraw cash anytime (24×7). The Indian Bank Debit cards are issued at the time of account opening for free of cost. These cards can be used in more than 1 million ATMs all over the world.

Rupay Platinum Card

The Indian bank provides a special card for its customers, which is specially used in India only. This card is designed especially for economically weaker people at no maintenance charge.

Benefits and Features:

- The Rupay card has minimum transaction charges, which are the most suitable and convenient for the poor people in India.

- They are specially designed for the Indian People.

- There is no charge for the first year; however, the bank charges a minimum fee, including GST, from the second year onwards.

- The Rupay card has a service fee of only 25 INR to make a duplicate PIN.

- In case of theft or loss, the bank charges Rs.50 for issuing a new card.

PMJDY Card (Pradhan Mantri Jan Dhan Yojana)

Prime minister Narendra Modi initiated the PMJDY (Pradhan Mantri Jan Dhan Yojana) on 15 August 2014. Under this scheme, Jan Dhan’s bank accounts were opened to the poor citizens of India for free of cost. These accounts were zero balance accounts with the facility of Jan-Dhan Rupay cards.

Features and Benefits of Rupay PMJDY Cards:

- These PMJDY cards were given to all account holders having a Jan-Dhan account for free of cost to facilitate their cash withdrawals.

- However, the account holders were only allowed to withdraw 25000 INR (Twenty-five thousand rupees) per day.

- This card was not acceptable for online transactions as it was launched for only poor people of India.

- The Indian Bank facilitated its Jan-Dhan cardholders an accident cover of one lakh rupees.

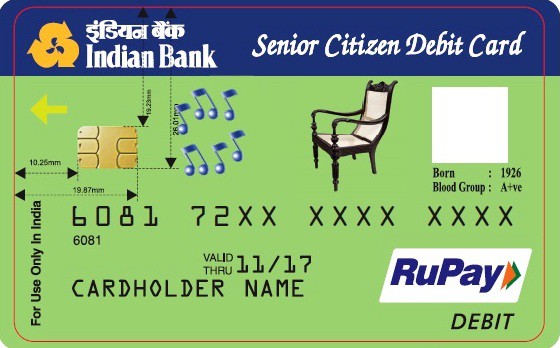

Senior Citizen Debit Card

The Indian Bank also facilitates their old age customers by providing special debit cards for them. This ATM card has a photo and blood group mentioned on the card to meet any emergencies.

Benefits and Features of Senior Citizen Debit Card of Indian Bank

- There is no ATM maintenance charge for a senior citizen’s ATM card.

- The withdrawal limit of Indian Bank senior citizen cards is twenty-five thousand.

- Blood group and photograph of the cardholder are available on the card to meet any emergency.

EMV World Mastercard

EMV World MasterCard form of Debit card is highly secured by a small chip embedded on the card. That’s why this card’s data is highly secured and almost impossible to clone. It is worldwide accepted.

Benefits and Features of EMV World Mastercard of Indian Bank:

- The Indian Bank Master card is acceptable in more than 200 countries.

- It has the highest withdrawal limits when compared to other cards. You can withdraw fifty thousand cash at once through this atm card.

- The online transaction limit of Indian banks is about one lakh rupees.

- The card has a super security facility to protect your cash or data from fraudsters.

- The Indian Bank master card has many other privileged facilities for shopping, airport lounges, and travel discounts.

RuPay Debit Select Card

- It is the top variant of Indian bank RuPay Cards.

- This card users get joining benefits & also the benefits on the base of Milestone.

- Debit select card of Indian bank also covers the insurance of ten lakh rupees for its consumer.

- The card has an additional benefit of lounge access at the airport with other money-saving offers.

IB DIGI – RuPay Classic Card

- RuPay classic card of IB- DIGI is for the customers who open their Digi account through an Indian bank application or their website online.

- The classic card of an Indian bank comes with a limit of 10 thousand rupees for shopping online.

- The card has a withdrawal limit of ten thousand rupees only through an ATM.

E – Purse Master Card

- E-purse debit card of Indian bank is the “award winning” premium platinum card.

- The card acts as a wallet; that’s why it is called E- Purse Debit card.

- E-purse cards can be offered or gifted to any of your family members or friends to use as a shopping card.

- The online consumers of Indian banks can Apply for this card by using net banking.

- The bank facilitates their E-purse consumers to send money in the wallet from the main account by using Indpay/internet banking facility. You can get an IndPay application on playstore, windows or on Appstore if using apple products.

- The card has won two awards.

- Banking Frontiers’ Finnoviti award in 2016

- MasterCard award for the best card.

MUDRA Card (Micro Units Development And Refinance Agency)

- Indian banks offer mudra cards for those who borrow mudra loans from the Indian bank.

IB Surabhi Platinum Card

- The card is especially designed for the Indian bank women Consumers who have IB Surabhi Account

- RuPay Platinum card of IB Surabhi has a fifty thousand withdrawal limit through ATM.

- However, it has one lac limit in terms of shopping online.

- The Surabhi platinum card covers the 2 lakh rupees worth’s insurance cover.

Indian Bank Debit Cards Eligibility

You can only own an Indian Bank Debit card if you have a bank account in Indian Bank. The bank account may be current or savings.

Documentation Required For Having An Indian Bank Debit Card

If you want to have an Indian Bank Debit card, first, you will need to open your bank account in the Indian Bank. For this, you will have to submit the following documents.

- Photo ID Card: Aadhar card, Voter ID card, or Passport.

- Residential proof: electricity bill, telephone bill, Passport, or gas bill.

- Passport-size photographs

- If you are a salaried person, you may also submit your salary slip or employment ID card.

- Now, fill the account opening application form and submit it to the Indian Bank. Your Indian Bank account will be open hand to hand, and the bank will provide all the facilities of ATM card cheque and the other facilities.

To Sum Up

The Indian Bank is the seventh-largest public sector bank in the country, which provides three ATM or Debit cards to their banking customers. The Indian bank has more than 114 years of history. The headquarters of the bank is in Chennai.

You can easily enjoy its ATM card facility or Whole banking facility by just opening your bank account here. For this, you will only need to submit some required documents like ID proof, Address proof, photo, and pan card details.

Recommended:

Debit Note and Credit Note: Key Difference & Similarities

10 Best Virtual Debit Cards In India