Implementing technology in finance and banking has fundamentally changed how we conduct transactions globally.

Decentralization might be the future of central banking even though it is centralized at the moment. Decentralized finance led to a renaissance of finance, not just in banking but in all facets of the financial domain.

Crypto enthusiasts know that DeFi is one of the hottest topics in the world of cryptocurrency and blockchain.

A DeFi solution can replace centralized financial institutions such as banks, stock exchanges, and insurance firms.

DeFi systems establish distributed consensus using “smart contracts” on blockchains like Ethereum distributed ledgers.

Investing in peer-to-peer transactions has become increasingly convenient in an increasingly digitized financial world, which is why DeFi focuses on offering that ease to investors.

The DeFi ecosystem enables lending, borrowing, trading, saving, and earning interest-free of the typical bureaucracy and complexity.

Smart contracts, storing digital contracts on the blockchain, are an essential component of DeFi.

Goals Of The DeFi Network

1. Ditch The Paperwork

Smart contracts are processed digitally using blockchain technology, eliminating the need for paper documentation and waiting for transactions to clear through the bank.

2. Cut Out The Middleman

Human intermediaries are eliminated due to automating the contract-processing on the blockchain, which eliminates the need to engage outside mediators like lawyers to handle agreements between parties.

3. Pick Up The Pace

As a result of not relying on multiple parties or dealing with long wait times to execute a transaction, DeFi makes doing business a more fluid and efficient experience from beginning to end.

4. Equalize The Opportunity

Major financial institutions such as hedge funds and banks are typically the only ones with access to the financial opportunities made available through DeFi platforms. DeFi is bridging the gap between the average person and the financial oligarchy, and it is doing so quickly.

Top 18 DeFi Companies

1. Aave

Aave (AAVE), launched in 2017 under ETHLend, is one of the first DeFi platforms to enter the market and is still in operation today.

In addition to allowing for the borrowing of assets and the earning of rewards on deposits, Aave is a decentralized liquidity platform.

A decentralized environment is created to facilitate an equal opportunity lending system by bringing together lenders and borrowers by staking the AAVE coin on the Aave DeFi platform.

2. Avalanche

Avalanche (AVAX) bills itself as “the fastest smart contracts platform in the blockchain industry” while also establishing a foothold in the burgeoning NFT space and establishing connections with other blockchain projects such as SushiSwap (SUSHI), Chainlink (LINK), and the Graphene network (GRT).

The project sees itself as a direct competitor to Ethereum because of its ability to provide cheaper transactions in a fraction of the time it takes Ethereum to complete a transaction.

In recent months, Avalanche has completed $230 million in funding to support its DeFi initiatives, making it a compelling location for DeFi projects to establish a base of operations.

3. Cardano

Cardano is one of the world’s most significant blockchain initiatives and is commonly referred to as the “Green Blockchain” due to its fantastic energy consumption reporting and proof of stake protocol.

Cardano said last month that its recent $100 million investment in decentralized finance, non-financial tokens (NFTs), and blockchain education would help the cryptocurrency ecosystem grow.

4. Chainlink

Chainlink (LINK), seeks to integrate smart contracts with facts from the real world through oracle technology.

In recent news, Chainlink announced the creation of a Programmable Token Bridge, which will enable new communication between DeFi blockchains.

This will allow DeFi to scale correctly and avoid the bottlenecks that have plagued the prior generations of blockchain initiatives, which would benefit all parties involved.

5. Polkadot

Polkadot (DOT) is a protocol that enables separate blockchains to share information and transactions in a trustless manner through the Polkadot relay chain, which is a decentralized internet.

As a result, Polkadot and projects that choose to build on Polkadot are far faster and more scalable than Ethereum’s present platform.

By serving as a foundation for DeFi projects to build on, it contributes to the overall growth and potential of the network.

6. Terra Luna

A new generation of innovative contract platforms, Terra Luna, combines decentralized finance with the concept of stable coins to create a new kind of cryptocurrency.

Its platform offers stable coins, digital assets that provide instant settlements, cheap fees, and smooth cross-border trading.

Luna is the volatile backbone that ensures that Terra, its stable coin twin, remains balanced and grounded in the market.

When you combine the rising popularity of DeFi with the severe attention stable coins are receiving — from consumers and governments alike, LUNA is a cryptocurrency to keep an eye on.

7. Polygon

In the world of Ethereum Layer 2 scaling solutions and decentralized application ecosystems, Polygon (MATIC) is one of the most widely-adopted and fastest-growing solutions.

It has many advantageous characteristics, including interoperability, scalability, and security.

For the most part, Polygon adds a few additional traffic lanes to the already frequently used Ethereum Layer 1 motorway.

The bulk of DeFi projects is presently hosted on the Ethereum blockchain, a distributed ledger technology.

Consequently, lower Ethereum congestion leads to faster speeds and greater benefits for the DeFi ecosystem.

8. Solana

Solana (SOL) is changing consensus in the cryptocurrency world. Rather than relying on mining or staking on the platform to confirm transactions, the blockchain serves as a timestamp for all transactions, proving that they were made at the time specified.

Solana is often seen as Ethereum’s primary competitor because it offers high transaction speeds while remaining a Layer 1 platform, which means it does not require assistance from another platform to complete these speedy transactions.

9. Synthetix

It is possible to trade cryptocurrency for stocks, commodities, currencies, and other assets on Synthetix (SNX), a rapidly growing decentralized exchange.

This allows crypto to be traded for assets currently dominated by traditional financial institutions on Wall Street, London, and Hong Kong.

Its main distinguishing feature is that it allows users to create their synthetic assets, referred to as “synths,” which may be used to gain exposure to cryptocurrencies, fiat, derivatives, and other asset classes.

Because of this, customers may place bets on the price of an asset without having to possess the actual commodity, making Synthetix one of the most popular DeFi products available today.

10. Compound

Based on the Ethereum blockchain, Compound provides a decentralized money market protocol that allows holders of digital assets to borrow and lend crypto in exchange for collateral.

Compound’s liquidity pool lets you immediately add assets, and you will begin earning compound interest.

The interest rates automatically alter in response to changes in supply and demand. 10% of the interest paid is kept aside as reserves, with the remaining ninety percent flowing to liquidity providers.

Currently, the protocol has over $6 billion in liquidity pools, establishing it as one of the most popular decentralized financial infrastructure platforms available.

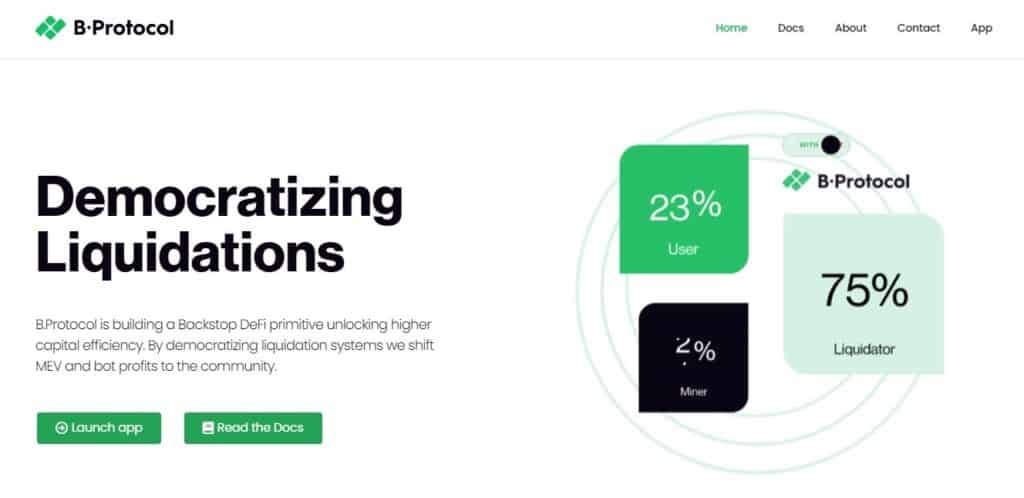

11. B.Protocol

B.Protocol is a backstop liquidity protocol that aims to increase the stability of decentralized lending platforms by offering a backstop liquidity solution to the network.

In the interest of the B.Protocol users, liquidity providers share their proceeds with them in exchange for receiving a priority in the liquidation process.

They are intended to attract committed liquidators to the platform and assist in redistributing miner extracted earnings back to the platform’s users. Users can engage with lending platforms through a specialized smart contract interface, and in return, they will obtain a Rating score based on how well they use the protocol.

The funds from each liquidation completed using the B.Protocol are divided between the liquidators and a third party.

The Jars are unique to each loan process. Once the proceeds in the Jar have been accumulated for a long time, the proceeds are dispersed among the Jar’s users following their Rating score.

12. Beta-finance

Beta Finance is a permissionless money market technology that allows users to lend, borrow, and short cryptocurrency across multiple chains.

DeFi natives can now take the opposite side of a trade and counter volatility with a single click. Anyone, anywhere, at any time can create money markets for tokens on the fly — enabling new asset utilization.

Beta Finance has developed an integrated “One-Click” Short Tool that allows anyone, anywhere, at any time to create money markets for a token on the fly — unlocking new asset utilization.

Using crucial DeFi technologies and infrastructure, Beta Finance aims to reduce volatility and increase stability for the long-term, widespread adoption of distributed ledger technology (DLT) by individuals and institutions.

Beta Finance, which places a strong emphasis on the user experience, enables DeFi customers to begin, manage, and close short positions with a single click, while also giving essential metrics and information before position execution.

Lenders will be able to lend out any token, thereby creating the market without the need for approval if it does not currently exist, and will begin earning interest on their holdings.

13. MAKER

It is an Ethereum-based permissionless lending platform. DAI is the world’s first decentralized stable coin and the first cryptocurrency built on the Ethereum blockchain.

When it comes to the overall quantity of ether (ETH) locked within the system, Maker has long been considered to be the pioneering DeFi project, and it has consistently ranked first on practically all DeFi tracking platforms since its launch in 2013.

Maker is a cryptocurrency lending platform that, for those who are unfamiliar, allows any user to autonomously take out a loan (in Dai) by using digital assets such as ether (ETH) as collateral.

Because the system is inherently permissionless, there are no Know Your Customer criteria to meet to get started.

Aside from that, all lending operations are carried out by smart contracts, which means that no human is involved in facilitating any individual loan in question.

Maker operates on the back of a native token called MKR, primarily used as a governance token, allowing users to vote on new features and updates to the platform.

Beyond governance, MKR is used to pay for stability fees, and, in an emergency, it is sold as a last option to bootstrap the network to ensure Dai retains its 1:1 peg to the US Dollar.

14. NUO

Nuo Network offers a decentralized debt marketplace that allows users to interact with tokens based on Ethereum.

A daily interest rate is paid out on Nuo’s lending product, allowing users to contribute cash to a reserve pool while earning interest.

Nuo Borrow allows users to over-collateralize their loans to trade on margin with up to three times the leverage.

Nuo users do not have to pay transaction fees after making their initial payment because the platform uses meta transactions.

15. Uniswap

When it comes to DeFi protocols, Uniswap is one of the most well-known names in the industry. It charges absolutely no costs for listing currencies, and users have complete control over their assets, which they can access securely and effortlessly.

As opposed to a centralized exchange, this provides a significant competitive advantage. Uniswap has two smart contracts; the smart exchange contract and the factory smart contract, which distinguishes it from the competition.

Each Smart contract serves a specific purpose, and because they both operate independently of one another, the entire process is smooth and requires little to no involvement.

The factory contract ensures that new tokens are added to the network regularly. As the name implies, the exchange contract makes it possible to swap and trade tokens.

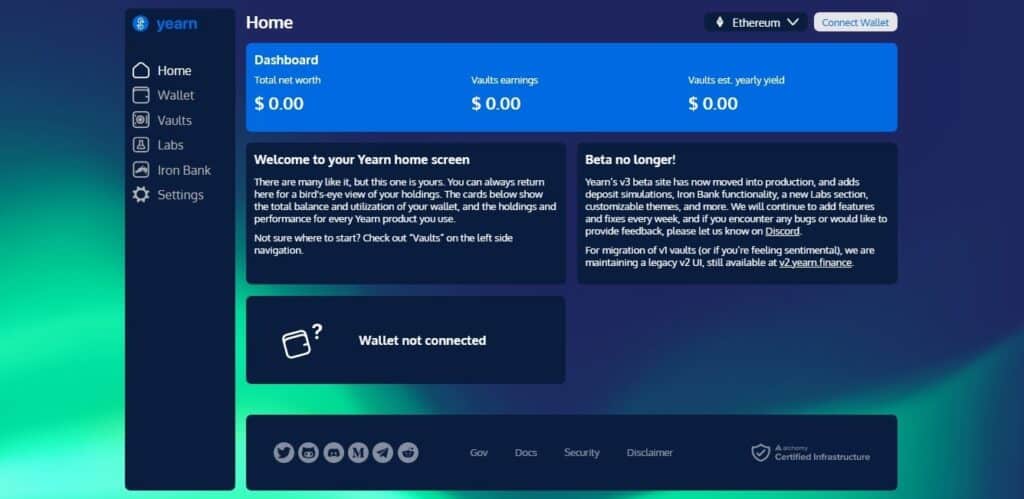

16. Yearn.Finance

A DeFi aggregation platform focuses on loan, borrowing, and one of the most legendary ways to earn cash in the DeFi ecosystem, yield farming, Yearn.Finance is a platform that aggregates DeFi platforms.

Yearn.Finance is a platform that aggregates DeFi platforms. Every DeFi protocol, including Yearn.Finance operates on the Ethereum blockchain, just as most other DeFi protocols do.

Yearn.Finance makes it a priority to maximize the earnings of any individual who participates in yield farming platforms that generate stablecoins.

It automatically rotates between several loan platforms, making it significantly more profitable than any other form of investment available today.

It’s similar to a mutual fund in that the platform itself invests in areas where the platform can maximize the user’s profit.

Yearn.Finance offers users various solutions that they can use to manage their finances.

17. Pancakeswap

It is a DeFi application that allows blockchain developers to establish their cryptocurrency projects, swap cryptocurrency coins, engage in crypto farming, and also it allows them to stake their crypto assets.

Since it uses Binance Smart Chain instead of most of its competitors, it is more secure.

This blockchain, developed by one of the most well-known cryptocurrency exchanges globally, possesses all of the qualifications necessary to replace Ethereum as the preferred blockchain for DeFi.

18. FalconSwap

FalconSwap is a second-layer protocol for DeFi that runs on the Ethereum blockchain. Other advantages include cheaper gas prices, increased privacy, and data aggregation.

These are just a few examples. The falcon pool and the falcon exchange are two of the company’s most generous offers.

There are other protocols, wallets, and exchanges with which it has merged and partnered to decentralize the financial sector further.

Unlike other immediate transaction platforms, FalconSwap does not require authorization and does not rely on front-running boards contributions.

As a result, you can rest confident that all of the liquidity and data that FalconSwap talks about are entirely accurate.

19. The Graph

The Graph is a decentralized protocol for accessing and indexing data from blockchains developed by the Ethereum project.

It works in the same way that Google indexes material on the web to make it more accessible. As a result, blockchains such as Ethereum and Filecoin are similarly indexed by The Graph.

The Graph was only capable of indexing on the Ethereum blockchain. The Graph organizes the data into available APIs, referred to as subgraphs.

Because of this procedure, developers will have an easier time querying the data through the Graph QI API.

Because it makes data easily accessible, it allows DeFi applications, such as DEXs, to run more efficiently because it offers the data they require.

A donation from The Graph Foundation to StreamingFast, an enterprise blockchain data provider, enabled this protocol to handle blockchains that were not compatible with the Ethereum blockchain. Developers use the Graph to gain access to prices and user information.

As of November 2021, the protocol can be found on 25 different blockchain networks.

Conclusion

DeFi has completely transformed the world of finance, and it is only a matter of time before it reaches maturity and becomes a legitimate alternative to traditional banks.

Now is an excellent time for any entrepreneur to hop on the DeFi bandwagon and either develop their DeFi platform or develop applications that run on the DeFi platforms already in place.

Simply contacting a Blockchain development company that understands DeFi will suffice. They will take care to present you with an excellent solution that will launch your business into a new era of financial prosperity in the blockchain world.