What Is The Full Form Of LIC?

LIC Full Form is Life Insurance Corporation

The Life Insurance Corporation of India is an Indian statutory corporation that is governed by the Ministry of Finance of the Indian government. Over 245 insurance firms and provident societies were amalgamated under the Life Insurance of India Act to become the nationalized state-owned Life Insurance Corporation of India.

The Life Insurance Corporation of India, which had a monopoly on soliciting and selling life insurance in India, had large surpluses from the start. By the end of the twentieth century, the company had expanded from 300 offices, 5.7 million policies, and a corpus of 45.9 crores to 25,000 offices, 350 million policies, and a corpus of over 800,000 crores. By 2006, Life Insurance Corporation was accounting for around 7% of India’s GDP.

Furthermore, their major role is to spread awareness about LIC in rural regions and among individuals from economically and socially disadvantaged backgrounds.

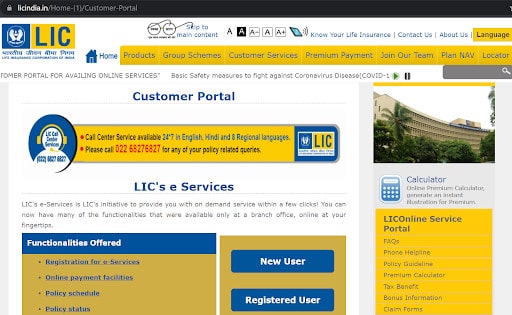

How Do New Users Check The Details Of Their Life Insurance Corporation Policy Online?

- New users must complete the registration form found on the LIC’s official website. (www.licindia.in)

- Specific information is required for the initial registration procedure, such as the policy number, date of birth (D.O.B), email address, and the premium amount.

- A verification email will be sent to the registered email address after the process has been completed successfully.

- With the verification link provided in the email, one can easily access any policy-related information from their account.

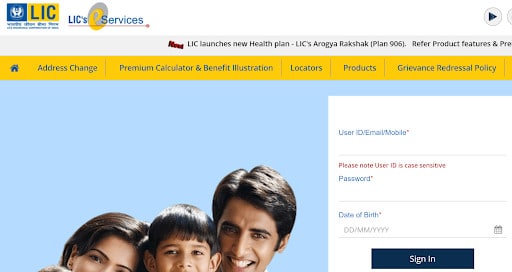

How To Check LIC Policy Details Online For Registered Users?

Following are the steps to check policy details online for registered users :

- Fill out the login ID, which is Username and Password, on the official LIC website, https://www.licindia.in/

- After successful login click on ‘View Enrolled Policies’.

- The website will immediately lead to another page where you may review all of the policies that have been enrolled.

- The current state of the insurance, as well as any vital information, will be presented in front of you.

Who Is Eligible To Use The LIC’s Online Services?

Individuals in India who have existing LIC policies can simply register for LIC’s online services without investing a dime. Furthermore, LIC provides exceptional services that allow the insured individual to enter the names of his or her spouse and children for registration.

How Does Life Insurance Corporation Recognize The Registered Policy Information?

- The bank/service provider transmits these details to LIC for validation and confirmation of the registration data at predefined intervals.

- The registration data is validated by LIC, and the registration status is sent to the bank/service provider.

- It usually takes a week for the confirmation for the registration data to get confirmed. As a result, the database of LIC works on a decentralized basis.

- LIC maintains a unified database of registered policies. After receiving the update from relevant operating branches, the database updates regularly.

- Moreover, LIC sends auto-mailers to enrolled policyholders notifying them of their registration status.

Using An Integrated Voice Response (IVR) System, How Can You Check The Status Of A Policy?

In nearly every city in the country, LIC has made an interactive voice response system available 24 hours a day, seven days a week. The UAN-Universal Access Number “1251” can be used to contact the LIC’s customer care department. Lastly, people can also reach out to the LIC’s regional and zonal offices.