The Internal Revenue Service (IRS) is responsible for collecting taxes and ensuring that taxpayers comply with the tax laws of the United States.

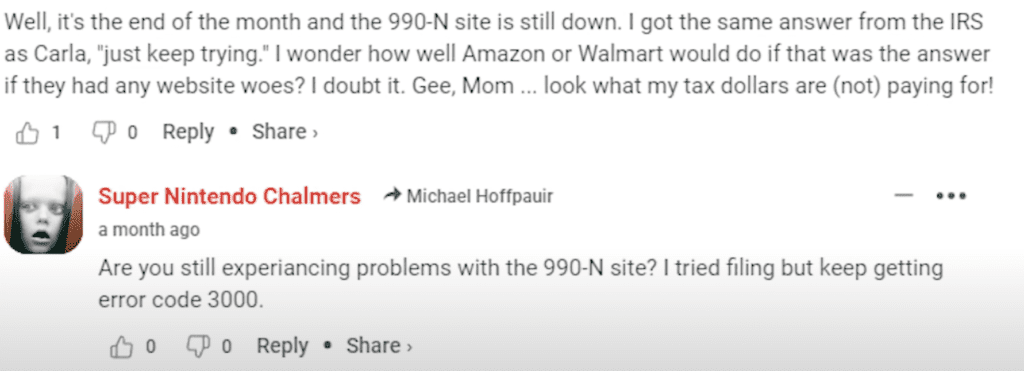

However, when trying to file the form, some organizations may encounter an error message that reads “Error Code 3000” on the IRS website.

This article explains what the IRS Error Code 3000 is, why it occurs, and how to fix it.

Why Does IRS Error Code 3000 Occur?

IRS Error Code 3000 typically occurs while filing 990-N (e-Postcard). This error code can occur for a variety of reasons, including:

1. You Have Provided IRS Incorrect Or Incomplete Information

If the taxpayer enters incorrect or incomplete information on their tax return, the IRS may be unable to process it, leading to the error code.

This can include misspelled names, incorrect Social Security numbers, or incomplete income information.

Therefore, it is crucial to double-check all the information before submitting the tax return to avoid any data entry errors that may lead to IRS error code 3000.

2. IRS Sever Technical Issues

IRS server technical issues can potentially cause the issue of IRS Error Code 3000 when filing the 990-N e-Postcard.

The IRS servers may experience technical difficulties, which can prevent the form from being submitted correctly, resulting in an error message being returned to the organization.

How To Fix IRS Error Code 3000

If you encounter IRS Error Code 3000 while filing 990-N (e-Postcard), there are several steps you can take to fix the issue. Here are some of the most common solutions:

1. Double-check The Information

Double-checking the information entered on the 990-N e-Postcard is an important step in resolving the issue of IRS Error Code 3000.

The error message can be caused by a discrepancy between the information provided on the form and the information the IRS has on file for the organization.

By double-checking the information, the organization can ensure that it matches the information on file with the IRS, and potentially resolve the issue.

2. Wait And Try Again Later

Sometimes the technical issues are temporary, and the IRS e-file system will be able to process your tax return after some time has passed. Try again later to see if the issue has been resolved.

3. Make Sure All The Check Box Are Checked

If you leave a required check box unchecked, it may result in an error and the IRS may be unable to process your tax return.

To prevent this issue, it is important to review all checkboxes on your tax return and ensure that you have marked all the required boxes accurately.

Double-checking your tax return before the submission is an essential step to avoid any errors.

4. Enter Your EIN ID Correctly

It is important to ensure that the correct EIN is entered on the 990-N e-Postcard, as errors in the EIN can also cause the form to be rejected by the IRS.

The EIN is a unique identifier assigned to the organization by the IRS, and it is used to identify the organization in all tax-related matters.

If the EIN is entered incorrectly on the form, the IRS will not be able to match the organization’s records with their filing, and the form will be rejected.

5. Use A Different Browser

Sometimes, technical issues can arise due to compatibility issues between the IRS e-file system and the browser being used.

Switching to a different browser may help resolve the issue if the current browser is causing compatibility problems.

It’s recommended to try using a different browser to see if it resolves the error code 3000.

6. Try Using A Different Device

It is possible that there may be technical issues with the device being used to file the form, which may prevent the form from being submitted correctly.

However, if the device is functioning correctly, and the organization is still receiving IRS Error Code 3000, using a different device will not resolve the issue.

7. Contact The IRS

If the issues still persist, contact the IRS e-file help desk at 1-866-255-0654. They may be able to provide additional information or guidance on how to resolve the issue.