Did your SBI ATM Card get Stolen? Did you lose or misplace your SBI ATM cum Debit Card? If you’ve lost your card, you’re pretty much out of luck. But don’t worry, This blog will guide you through the steps to Block your SBI ATM Card. Here is how you can block SBI ATM Card to prevent theft or to avoid losing all your money.

Why Should You Block Your SBI ATM Card If It Is Lost?

If your SBI ATM card is lost or stolen, you must report it and ensure that the card is blocked to prevent fraudulent or unauthorized activities. Blocking your card is the smartest thing you can do in this situation. The sooner you block your ATM card, the less likely you are to be a victim of fraud or forgeries.

Different Ways To Block SBI ATM Card.

Thankfully, SBI has provided several options for instantly blocking your cards. There are 5 ways to block your card.

1. Block SBI ATM Card Through Phone Call

In India, SBI has helpline numbers that are available 24 hours a day, seven days a week, on both mobile and landlines. To get an ATM card blocked, call one of these three helplines.

- 1800112211 (toll-free)

- 18004253800 (toll-free)

- +91-8026599990

2. Block SBI ATM Card Through SMS

Another option for blocking your SBI ATM card is to use SMS to block it in real-time. Send the SMS through the number that is registered with your account.

- Step 1: Create a new SMS message.

- Step 2: Type “BLOCK XXXX,” where XXXX refers to your SBI ATM/Debit card’s last four digits.

- Step 3: Send it to 567676

Your debit card should be disabled.

3. Block SBI ATM Card Through Net-Banking

If you applied for Net Banking on the SBI Website or app and submitted the necessary documents at the time, this solution will apply to you.

If you use net banking, you’ll have a username and a password. Follow these steps to Block your card:

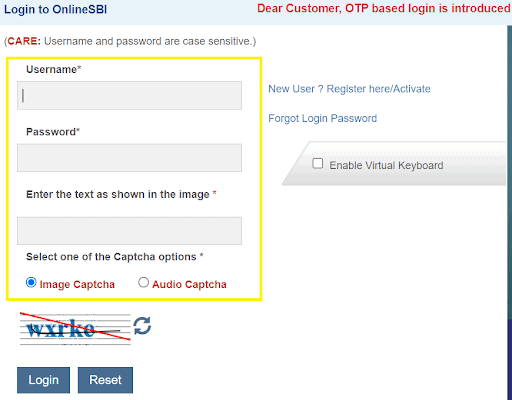

- Step #1: Enter your username and password and log in to www.onlinesbi.com.

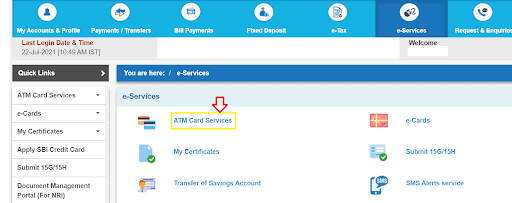

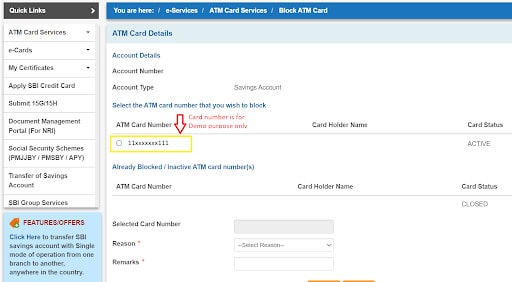

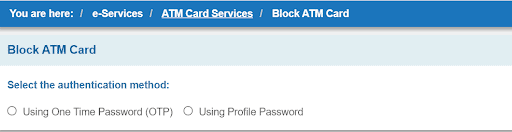

- Step #2: Go to the e-services menu, Select “ATM Card Services”.

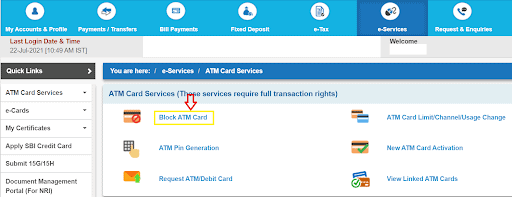

- Step #3: Click on or select “Block ATM Card”.

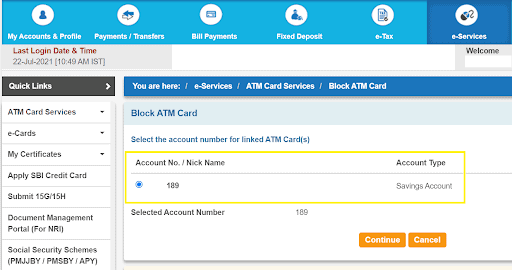

- Step #4: Next, choose the bank account to which the card you want to block is connected.

- Step #5: The first four and last four digits of all active and blocked card numbers will be shown on the next page.

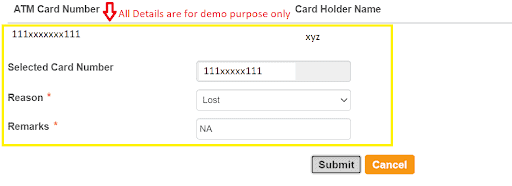

- Step #6: Then, select the card you want to block and the “reason” for blocking it.

- Step #7: After you’ve double-checked your information, click “Submit.”

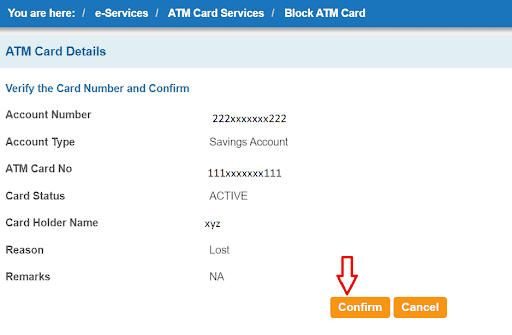

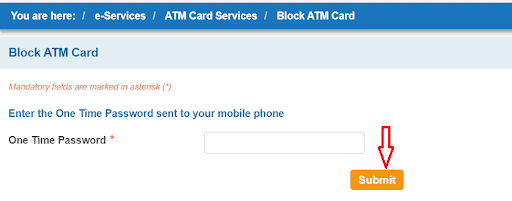

- Step #8: Then, select either SMS OTP or Profile Password option for identity authentication.

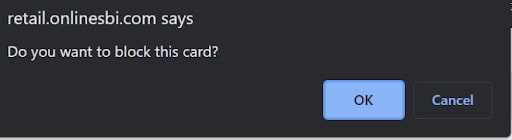

- Step #9: Lastly, after entering any of those, select ‘Confirm’

On successful submission of the request, a notification with a Ticket Number will be displayed to you confirming that your ATM/Debit card has been blocked.

Note: Note down the ticket number for tracking purposes.

4. Block SBI ATM Card Through YONO App

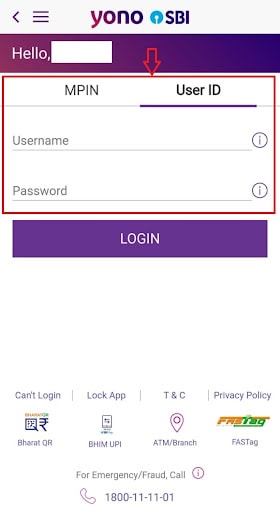

- Step #1: First, use your net banking username and password to log in to the YONO app.

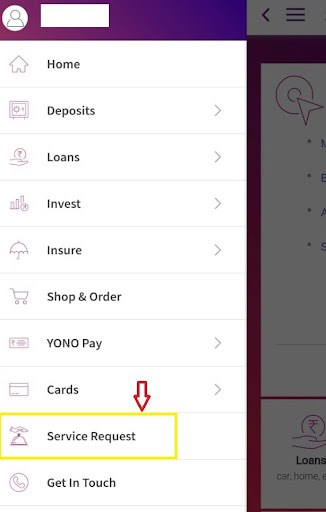

- Step #2: Then, On the homepage, click the section called “Services”.

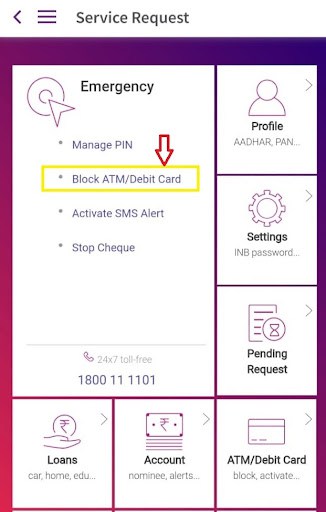

- Step #3: On the next screen, you’ll see some options. Select “Block ATM/Debit Card”.

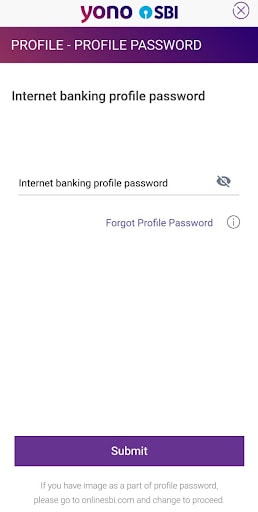

- Step #4: The Screen will ask the “Profile password” to proceed further:

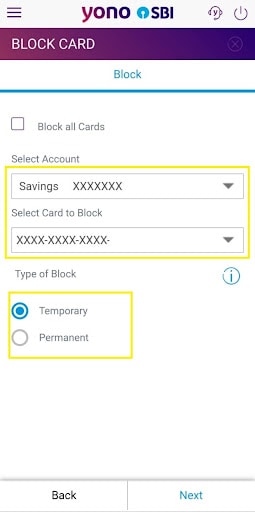

- Step #5: The screen will ask you to enter your bank account information. Choose the account that is linked to your ATM card. Below that, there will be an option to select an ATM or Debit card. Choose the card you want to block right now.

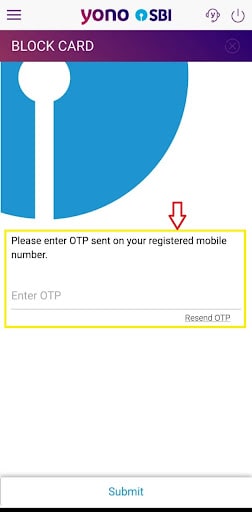

- Step #6: The final step is to verify where you have to select either “OTP” or “Account Password”. Choose the best option for you and enter it and click “Submit.”

If you followed the steps above, the following screen will display a message confirming that your request was successful.

5. Block SBI ATM Card Through Email

You can also request to block the ATM Card by sending an email.

- Step 1: Compose a mail with the ATM Card Number and the reason why you want to block your card

- Step 2: Send your message to [email protected].

The card will be blocked, and you will receive an email or SMS confirmation.

How Long Will It Take To Block Your SBI ATM Card?

Once you have used any of the ways to block your ATM card, it will get blocked almost immediately within that same day. You will receive a confirmation message upon the successful blocking of your card. You can then apply for a new ATM card for the same account.

Can A Blocked SBI Card Be Unblocked?

Yes, your blocked SBI Card can be unblocked. If you block your card yourself, you’ll need to visit your SBI bank branch to unblock it. All you have to do is submit a written application along with the cardholder’s identification documents so that the bank may proceed with the unblocking of the ATM card.

Frequently Asked Questions

How Can I Block An SBI ATM Card By Phone?

You can block your SBI ATM card by using your phone by calling the toll-free SBI helpline number 1800 11 2211 to get your card blocked or by sending an SMS to 567676 from your registered number to block your card.

How Can I Block My SBI ATM Card If Lost?

You can block your SBI ATM Card in a variety of ways, including Net Banking, Yono App, SMS, Phone Call, Email, and visiting your bank.

How To Block SBI ATM Card Offline?

You can block your SBI ATM Card/Debit Card offline by either using the SMS option through your registered number or by calling on the toll-free helpline at 1800 11 2211 to block your card. You can also visit your SBI Branch to get your card blocked.

How To Block An SBI ATM Card Without A Password?

You can block your SBI ATM Card even without having a username or password. You can simply call SBI’s toll-free helpline number at 1800 11 2211 or send an SMS at 567676 from your registered number to block your card. You can also send an email or visit your branch to get your card blocked.

How To Block SBI ATM Card Permanently?

You can block your SBI ATM/Debit card permanently through Net Banking, Yono App, or Mobile Banking or SMS.

How Can I Block SBI ATM Card Without My Card Number?

You can send an SMS to 567676 from your registered mobile number like

“BLOCK<SPACE>last 4 digits of your card”.

Customers can restrict their SBI ATM/Debit card using different methods. You can choose any of the alternatives that are most convenient for you. While you have round-the-clock access to Internet Banking, calling customer service, and sending SMS or e-mail, visiting the branch has some limitations. Choose the most convenient option to have your stolen ATM card blocked. Hope this article was helpful. you can read our other articles here.