To make transactions from the Central Bank of India account, customers need to register a beneficiary first. For every online fund transfer including RTGS and NEFT, a beneficiary is mandatory.

To add beneficiaries, CBI customers can consider the following guidebook. Beneficiaries can be added using CBI Net Banking and CBI Mobile Banking (CENT Mobile).

What Is A Beneficiary?

When a remitter transfers money to another bank account. The receiver of the funds is known as a beneficiary. A beneficiary can be an Axis bank customer or can be a user of different bank services.

Add Beneficiary In Central Bank Of India Using CBI Net Banking

Steps to add beneficiary using CBI Mobile Banking(CENT Mobile):

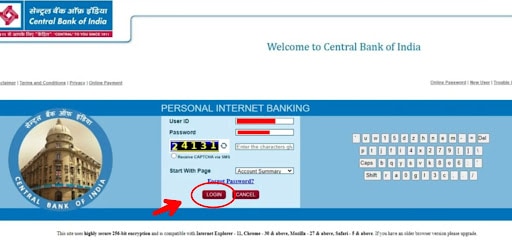

Step #1: Go to the official website of the Central Bank of India Netbanking.

Step #2: Enter the website by providing your Login details.

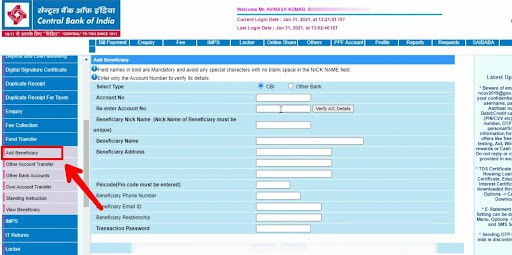

Step #3: Open the menu, select the “Fund Transfer” option.

Step #4: Now, select the “Add beneficiary” option. The website will ask for the “Fund Transfer Type”.

Step #5: If your payee is an account holder of the bank, then choose “CBI account” or if the payee does not have a CBI account then choose “Other Bank Account”.

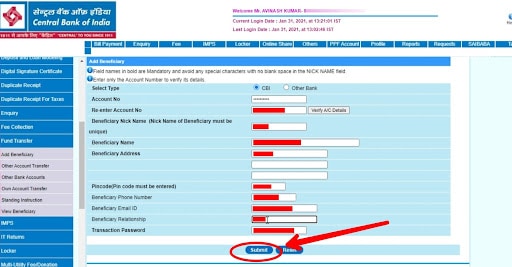

Step #6: Enter all the details such as Bank Name, IFSC code, Nickname, or Account number.

Step #7: Check all the details and submit them by clicking on the “Submit” button.

Step #8: Finish the grid authentication. Your beneficiary will be added.

Add Beneficiary In The Central Bank Of India Using CBI Mobile Banking (Cent Mobile)

Steps to add beneficiary using CBI Mobile Banking(CENT Mobile):

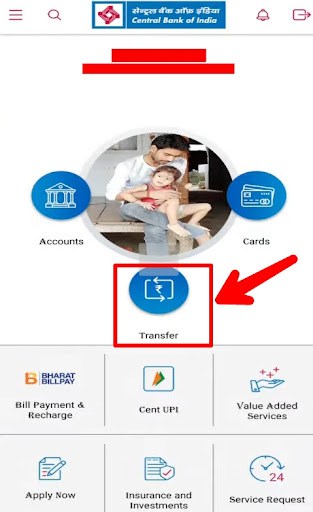

Step #1: Download and open the CBI mobile banking application, CENT Mobile).

Step #2: Enter the application by providing your log-in details.

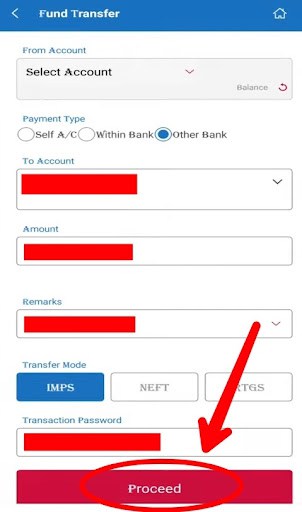

Step #3: From the menu, click on the “Fund Transfer” option.

Step #4: On the next screen, tap on the “Manage Beneficiaries” option.

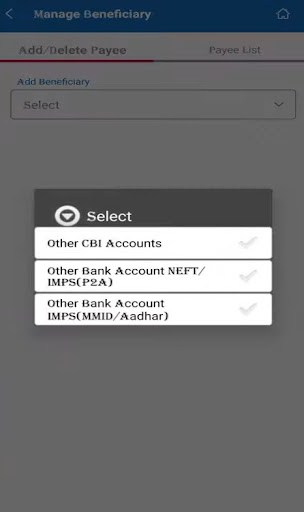

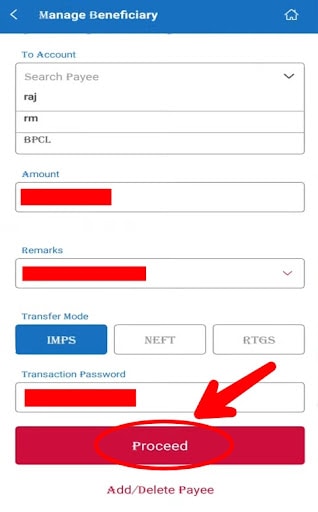

Step #5: Now, choose your payee transfer type. If your payee is an account holder of the bank, then choose “CBI account” or if the payee does not have a CBI account then choose “Other Bank Account”.

Step #6: Now, the application will ask you to fill in all the beneficiary details such as beneficiary limit, account number, nickname, IFSC code, etc.

Step #7: Once you fill in the details, tap on the confirm button.

Step #8: Your beneficiary will be added using the Central Bank Of India’s CENT Mobile application.

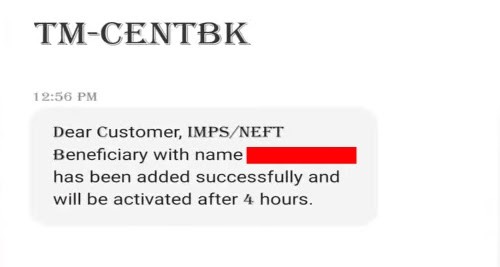

Step #9: After completing the process, the bank will send you an SMS for confirmation.

Central Bank Of India Beneficiary Activation Time

Within four hours, the beneficiary will become active. The process of adding beneficiaries is now complete and you can now transfer the funds.

Recommended:

Central Bank of India Timings & Working Hours

7 Ways To Get CIF Number In Central Bank Of India

Frequently Asked Questions

How Much Time Does It Take To Add Beneficiaries To The Central Bank Of India?

Central Bank of India approves the request for a new addition of the beneficiary within 4 hours.

What Are The Charges For Adding A New Beneficiary To The Central Bank Of India?

The bank does not charge any fee for adding a beneficiary.

What Is The Cooling Period For The New Beneficiary In The Central Bank Of India?

Ans: cooling period is the duration after adding a new beneficiary when the remitter’s transaction services are halted by the bank.

For the Central Bank of India, the cooling period is 4 hours.

What Is CENT Mobile?

CENT Mobile is a mobile application offered by the Central Bank of India. CENT Mobile allows the customers to get access to personal mobile banking.